Posted December 01, 2025

By Enrique Abeyta

Time for a Reality Check

Turn on the financial news. Any channel, any time.

What you'll hear is a symphony of panic, a relentless drumbeat of doomsday narratives that would make Cassandra blush.

The headlines are everywhere, each more ominous than the last.

"AI Bubble on the Verge of Collapse"... "Crypto Markets in Free Fall"... "Valuations Imploding as Reality Meets Hype"...

Wall Street's finest are practically tripping over themselves to declare that the market reckoning is not just coming — it's here, it's now, and it's inevitable.

The result? Paralysis.

Sheer, unadulterated terror is gripping the average investor so tightly that they've parked a staggering $7.39 trillion in money market funds.

That’s money sitting on the sidelines, earning pennies, waiting for a crash that the pundits promise is just around the corner.

But here's where this narrative falls apart...

Disconnect on a Massive Scale

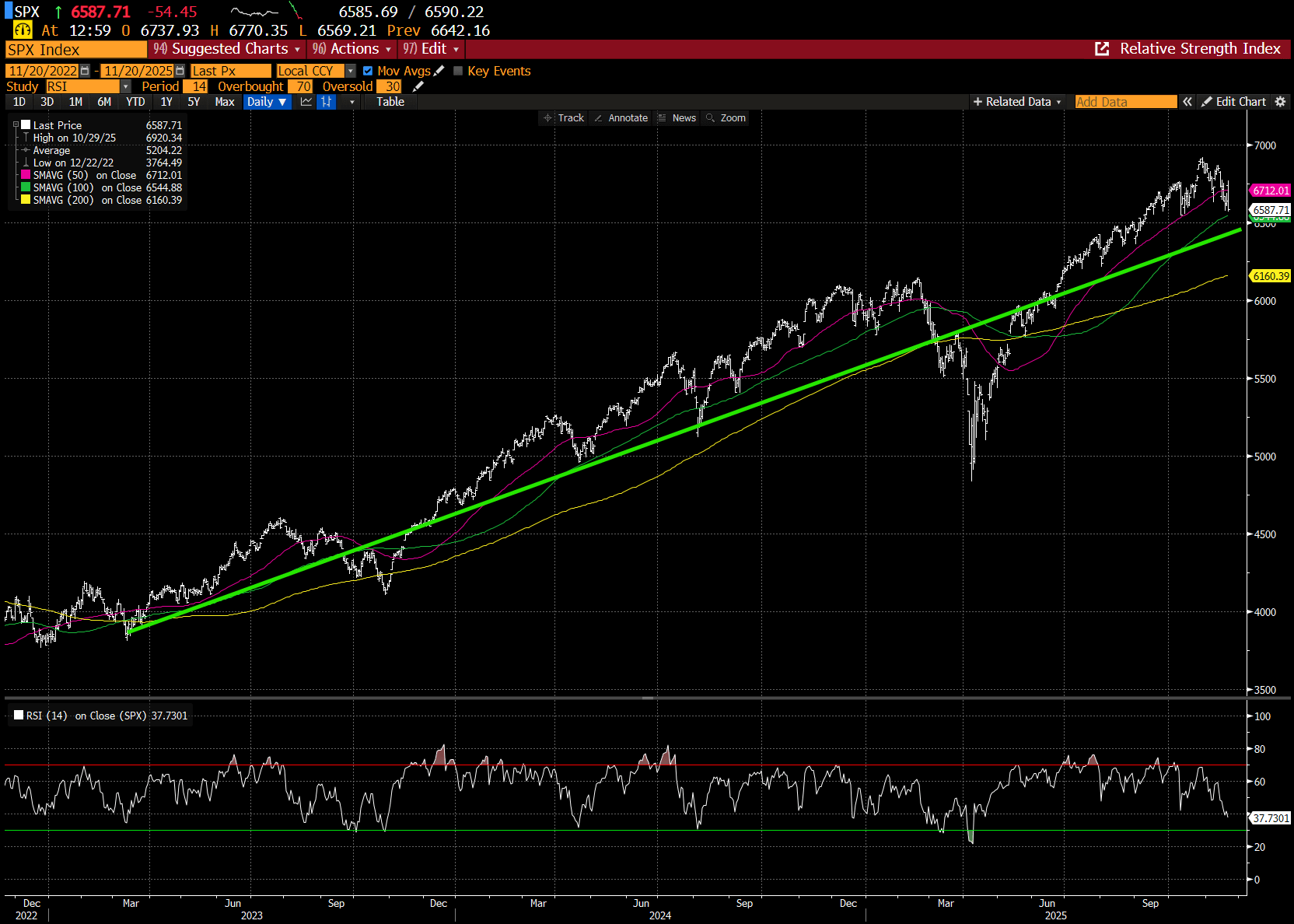

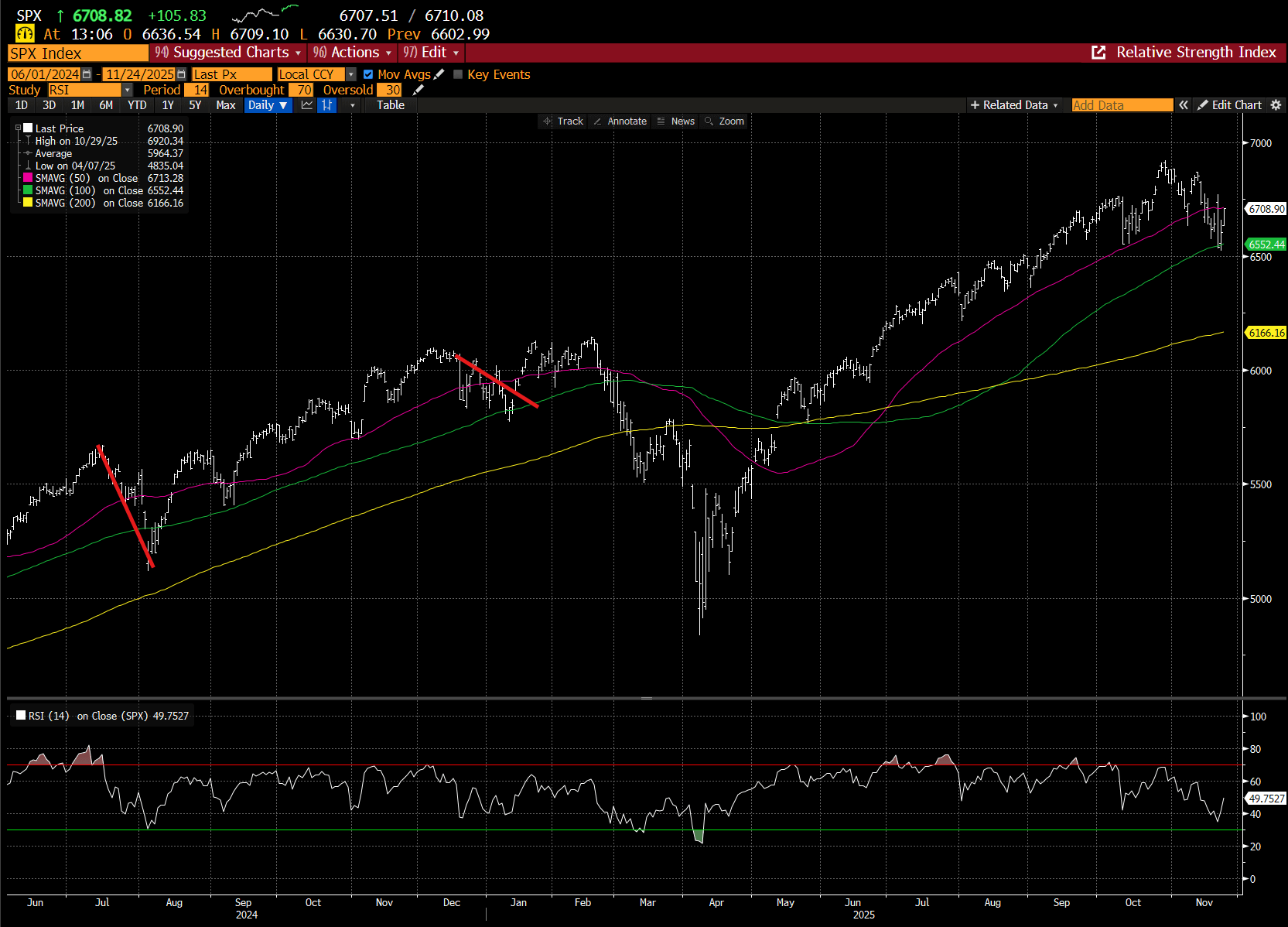

The S&P 500 is up over 16% year-to-date and continues to trade near all-time highs. Not down. Not collapsing. Not even correcting meaningfully. Up.

While it recently traded below the 50-day moving average after an extended period above it, it remains strongly in its uptrend.

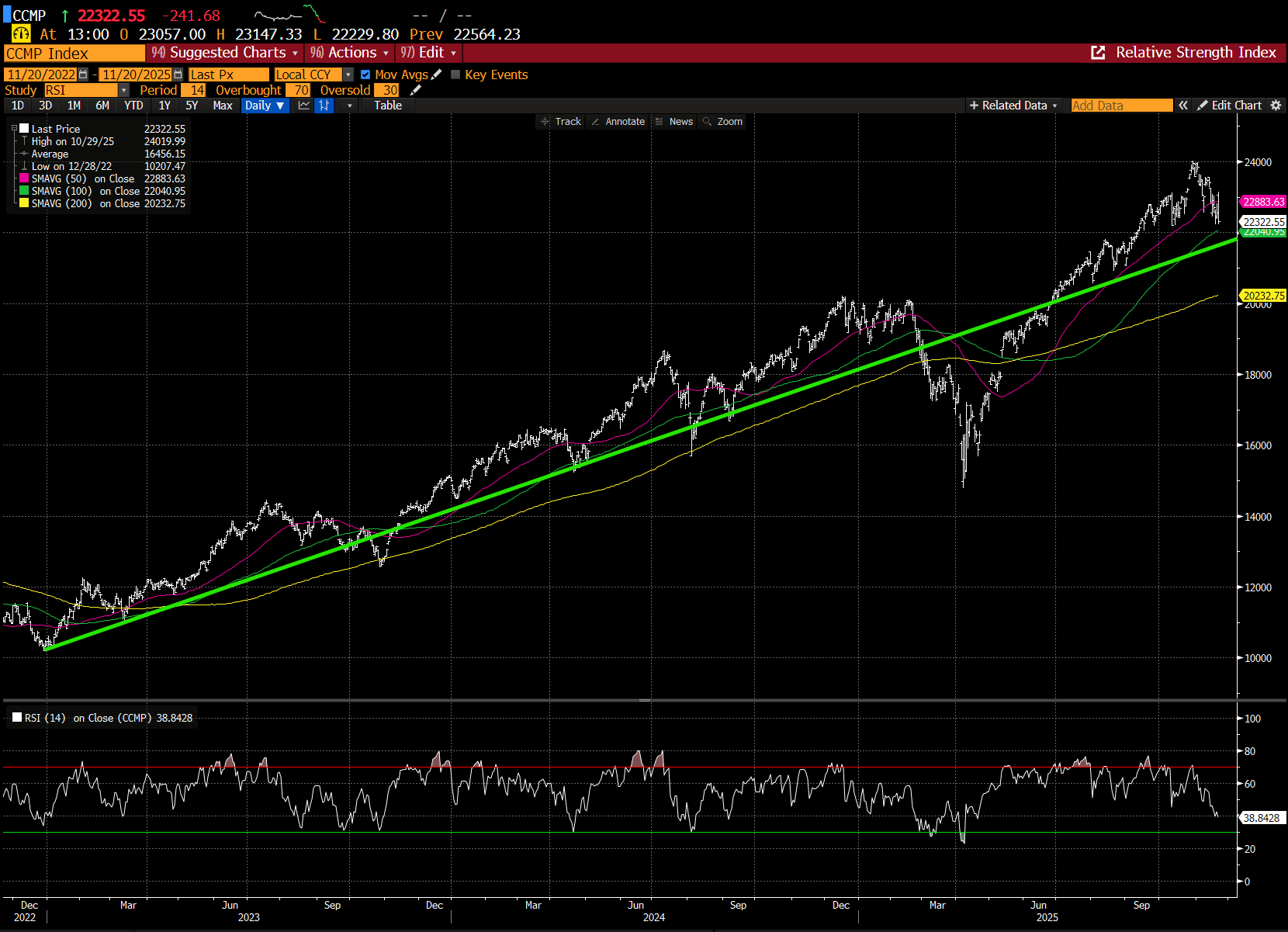

The Nasdaq? Same story.

Both indices remain firmly entrenched above their 100-day moving averages, still riding solid uptrends despite the noise.

The fear is deafening, but the market itself? It's not listening.

This is maximum cognitive dissonance.

This is the moment when fear and reality have completely diverged, creating an opportunity for those willing to see what's actually happening beneath the noise.

And what is happening? The data is undeniably robust.

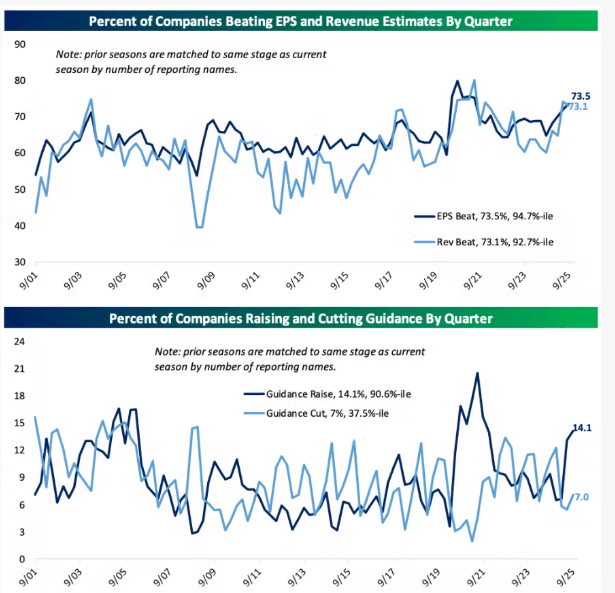

Corporate America delivered a powerhouse Q3 2025 earnings season.

The S&P 500 achieved a blended year-over-year earnings growth rate of 13.1% — and an astonishing 82% of companies beat their EPS estimates.

This isn't the picture of a contracting economy or wounded corporate sector.

This earnings performance ranked in the 90th+ percentile for both EPS and revenue beats, as well as for forward guidance raises.

This is legitimately strong data that the headlines are conveniently ignoring.

So yes, the fears are wildly overblown. And that's exactly why this moment matters.

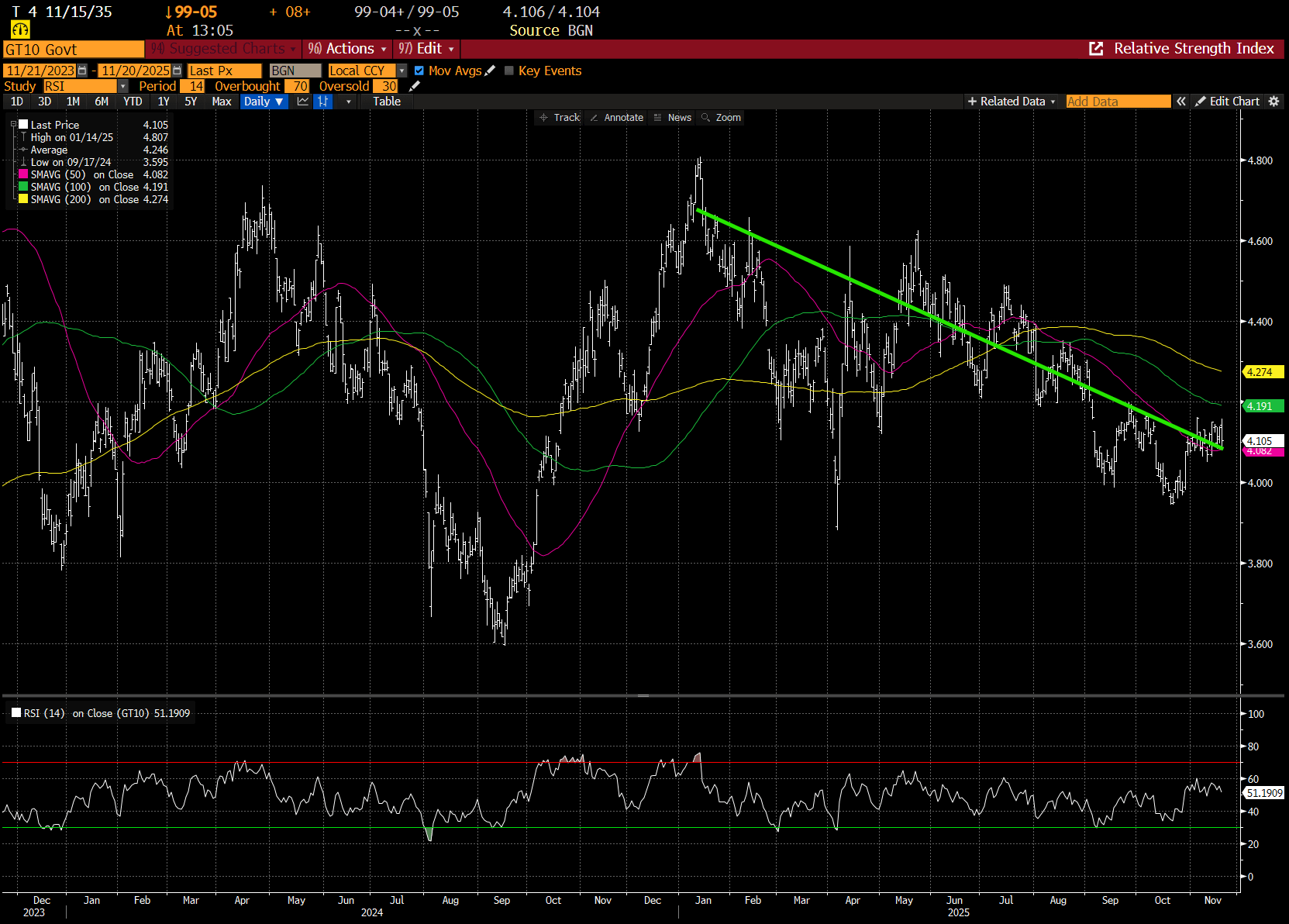

Perhaps investors are concerned about interest rates? High rates could hurt stock prices. They certainly did in 2022.

Here is the chart of the yield on the U.S. government benchmark 10-year bond.

Recently, there have been concerns that the Federal Reserve might not cut in the upcoming December meeting. But rates have been trending lower now for a year.

We can argue about how much they might go down and how fast. But with current Federal Reserve Chairman Jerome Powell out next year, I am confident they are going down.

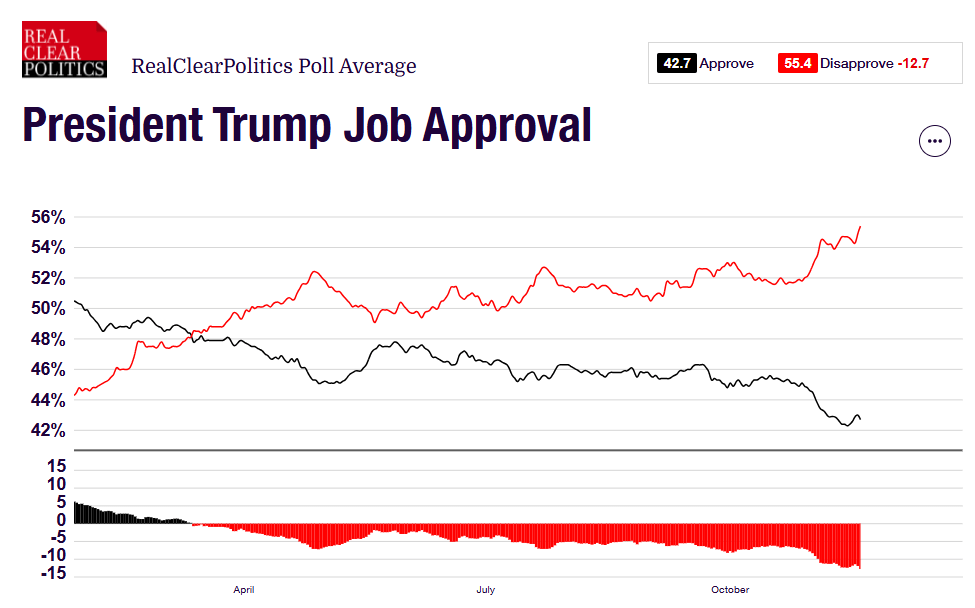

Here is another important chart when thinking about the U.S. stock market.

This is the chart of President Trump’s approval (black line) versus disapproval (red line) ratings. His job approval has clearly taken a hit.

After the most recent elections, it appears that the many controversial Trump policies are putting pressure on his political standing.

How do you think he will react?

My view is he will do everything he possibly can to try to improve these ratings going into next year’s crucial mid-term elections.

These were some headlines from the past week…

I’m not arguing whether either of these is good policy.

What I strongly feel, however, is that he is going to do everything he can to drive down inflation and put more money in consumer pockets.

That will NOT be bad for stock prices.

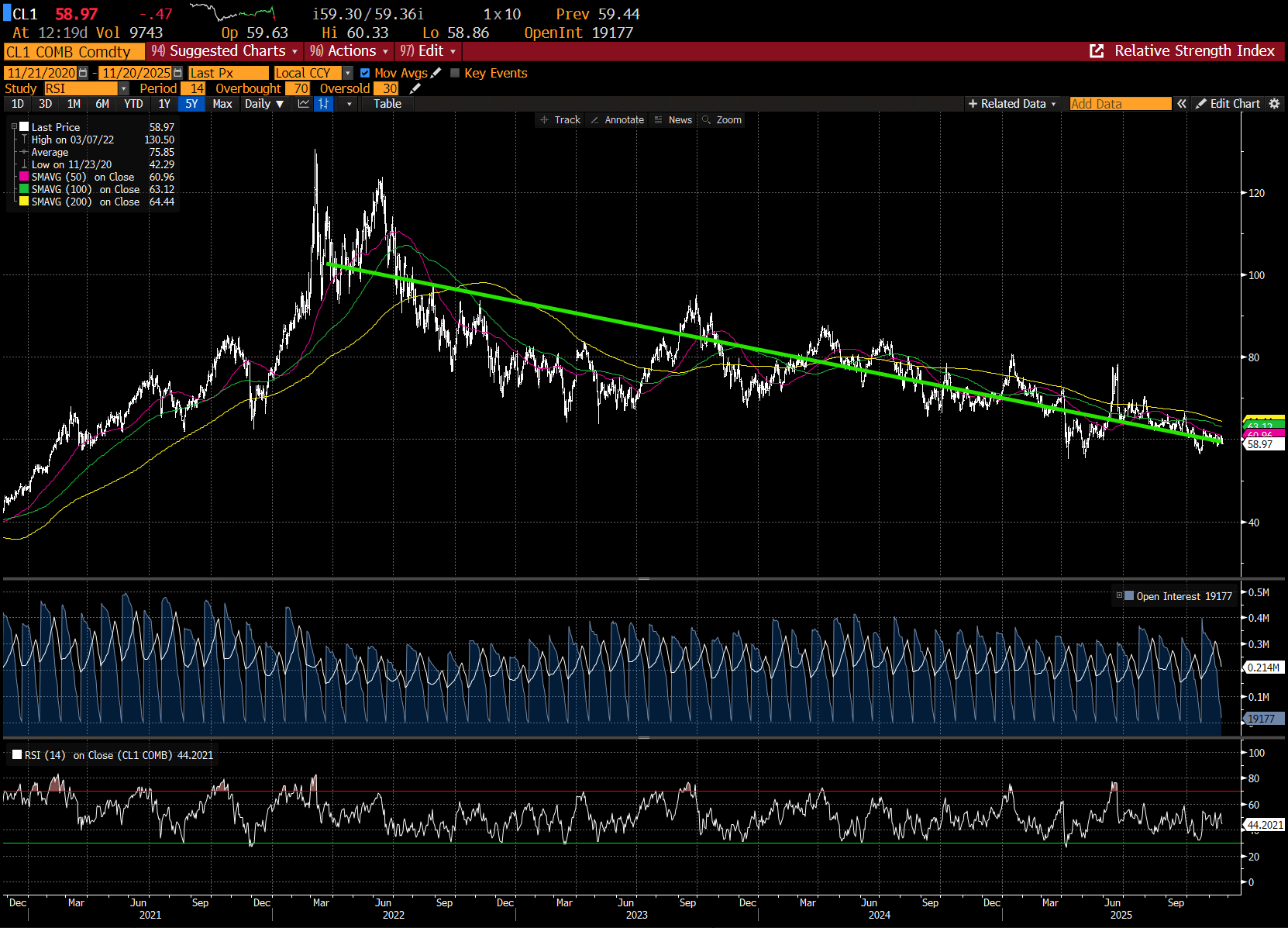

Here’s one last chart showing crude oil prices.

There is a clear downtrend here. In fact, oil prices are down almost 40% since just last September.

Have you been seeing all of this talk about regime change in Venezuela? I think it is very real and has to do with one — and only one — reason…

Oil. Trump has said he wants prices lower, and most analysts think this is below $50 or even $40 per barrel.

Venezuela has the largest reserves on Earth and is only a five-hour flight from Houston.

This recent selloff reminds me of two previous pullbacks we have seen in the last 18 months.

We’ve Seen This Setup Before

Most folks will think of the massive “Trump Tariff Tantrum” in April. But I think the better analogies are the selloffs in August 2024 and January 2025.

Here is a chart of the S&P 500 showing those periods (highlighted with red lines)…

The first of these was from the stock market high last July into early August.

If you recall, there was a massive spike in the volatility index and concerns that the Japanese yen carry trade was about to unwind.

I won’t rehash the specifics, but this steep move lower was centered around the very best stocks in the stock market.

We took advantage of it and doubled our open positions at the time.

The second of these was around the start of the year and bled into concern about the Chinese AI company DeepSeek.

Again, we took advantage of it. And all on one day, we purchased three positions that would each rise by double digits in less than two weeks.

I think that right now we are on the verge of ANOTHER one of these moments.

If the charts remain in uptrends and earnings are great… if rates, tariffs, and oil prices are all headed lower… and if Trump sends a $2,000 check out to most Americans…

Do you think we are on the verge of the next bear market? I don’t.

So now is an opportunity to go ahead and buy the dip once again.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

![[VIDEO] The Year-End Rally Is Back On!](http://images.ctfassets.net/vha3zb1lo47k/4mfoBVvX4hSw8BLbDAjPP7/c13db091bfeef2a493bcfd0f1e73df14/ttr-issue-12-05-25-img-post.jpg)

[VIDEO] The Year-End Rally Is Back On!

Posted December 05, 2025

By Greg Guenthner

The Truth About Stock Market “Voodoo”

Posted December 04, 2025

By Enrique Abeyta

Thankful for the Greatest Game on Earth

Posted November 27, 2025

By Enrique Abeyta

The Art of the Stop Loss

Posted November 25, 2025

By Ian Culley

A “Blue Owl” in the Coal Mine

Posted November 24, 2025

By Enrique Abeyta

![[VIDEO] How to Spot a Bounce Worth Buying](http://images.ctfassets.net/vha3zb1lo47k/52knC5jBCw9jj5rBVAQMRs/9213f9d92a2262a0ec1b42df9a62678d/ttr-issue-11-21-25-img-post-2.jpg)