Posted December 04, 2025

By Enrique Abeyta

The Truth About Stock Market “Voodoo”

Many investors think technical analysis is “voodoo.”

They dismiss it as squiggly lines for people who don’t understand fundamentals.

Sure, factors like a company’s revenue, earnings, and cash flow drive its stock price in the long term.

But in the near term, stock prices are also driven by human behavior. Forces like enthusiasm or fear that don’t show up on a balance sheet.

That’s why serious investors pay attention to technicals.

Not because charts tell the future… but because they reveal things that the fundamentals alone can’t tell you.

Today I want to talk to you about what technical analysis really is — and show you why it works far more often than skeptics think.

A Smarter Way to Think About Technical Analysis

Let’s start with a basic definition of the term.

“Technical analysis is a popular trading method that evaluates trading activity data, focusing on price and volume, to find investment opportunities and determine optimal trade entry and exit points. It contrasts with fundamental analysis, which assesses a security's value based on financial data like earnings and sales.”

Essentially, technical analysis involves looking at security trading data without considering anything else about the underlying company itself.

Most investors believe that the value of a stock is the sum of its future cash flows. For them, stock prices are a matter of physics driven by the underlying company's value.

However, genuinely sophisticated investors understand this concept is more like a "guideline" than a hard-and-fast rule.

Stocks can trade at significantly different values than the economic value of their businesses for long periods.

The enthusiasm of buyers and sellers drives the price of any stock in the short and intermediate term. I say "enthusiasm" because there's always a buyer for every seller, and vice versa.

What matters is whether the buyers are more enthusiastic and willing to pay a higher price than the sellers are eager to sell.

For some of the buyers and sellers, their perception of the "fundamental" value of the business may be the primary (or only) driver of their enthusiasm. People's perceptions of that value might be different.

There are also many other reasons buyers and sellers might have enthusiasm around a particular stock.

And thousands (or often millions) of participants of all different kinds have different reasons for buying and selling at a specific price.

It's impossible to have transparency to understand all of their motivations.

However, it is possible to understand the balance of their motivations in aggregate. This is done by looking at trading data — the goal of technical analysis.

Technical Analysis Gives You an Edge

For investors primarily focused on the fundamentals, this seems like "voodoo." However, think of the technical analysis as the waves and tides of the ocean.

These are the physical results of many physical inputs, things like temperature, salinity levels, wind, or the moon’s gravity.

Trying to understand all of these elements in a single equation is impossible. But we can see the waves and feel the tides.

They also happen over and over again in similar patterns.

Despite our ability to know the aggregate input of the many individual factors, we can make reasonably accurate predictions about what happens next through observing the outcome.

This is precisely what's happening with technical analysis.

We can't ever know the exact weighting of any input into the price action of individual stocks. But through time, the balance of these inputs results in similar outcomes.

It doesn't mean that the same pattern results in the same outcome every time. Still, it's often enough to make it statistically significant.

I'll give you my favorite gambling analogy for this...

Even though the dealer has yet to deal many face cards (or 10s), the next card will still be one.

It does increase the probability, though. And by increasing your bet, you can take advantage of it across a large group of decisions.

Technical analysis doesn’t promise certainty. Nothing in markets does.

What it offers is something far more practical… a repeatable way to identify when the odds tilt in your favor.

You don’t need to know every force behind a move. You only need to recognize when the collective pressure of buyers and sellers is shifting.

So treat charts the way a seasoned card player treats probabilities — not as guarantees, but as an insight.

Across many decisions, those insights can compound into meaningful results. That’s what technical analysis is really about.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

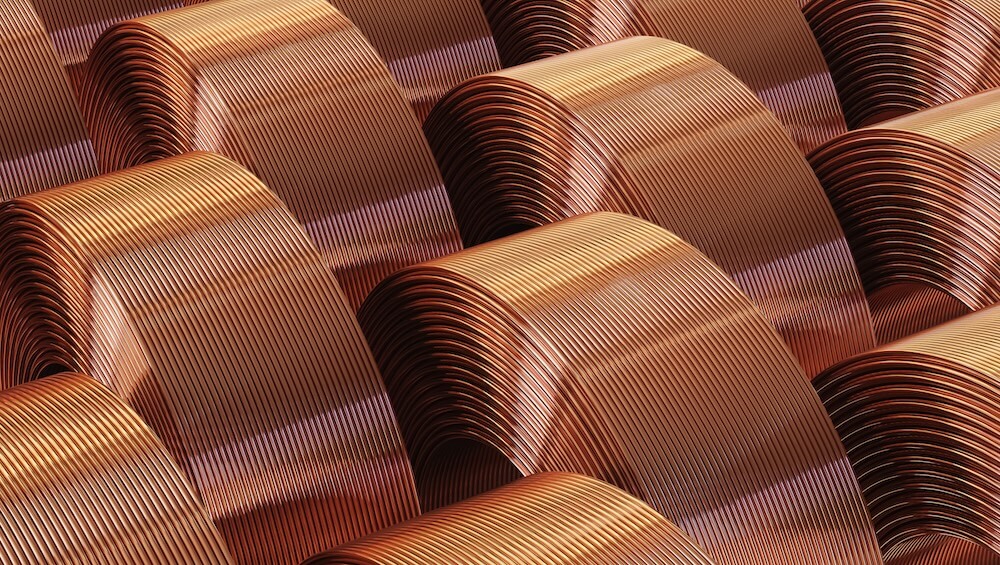

Breakout Alert: Copper Coils for a Monster Move

Posted December 02, 2025

By Ian Culley

Time for a Reality Check

Posted December 01, 2025

By Enrique Abeyta

Thankful for the Greatest Game on Earth

Posted November 27, 2025

By Enrique Abeyta

The Art of the Stop Loss

Posted November 25, 2025

By Ian Culley

A “Blue Owl” in the Coal Mine

Posted November 24, 2025

By Enrique Abeyta

![[VIDEO] How to Spot a Bounce Worth Buying](http://images.ctfassets.net/vha3zb1lo47k/52knC5jBCw9jj5rBVAQMRs/9213f9d92a2262a0ec1b42df9a62678d/ttr-issue-11-21-25-img-post-2.jpg)