Posted October 03, 2025

By Greg Guenthner

The Premier Anomaly: Why Momentum Trading Has Captivated Wall Street for 30 Years

There's a scene that plays out in nearly every investment seminar.

Someone in the audience asks if it's possible to consistently beat the market.

The speaker (usually quoting Eugene Fama, father of the Efficient Market Hypothesis) smiles and says, "Sorry, but research shows you can't."

Except that's not quite what Fama said.

In fact, the Nobel Prize-winning economist who built his career proving markets are efficient, made a stunning admission: There's one glaring exception to his theory.

One pattern that refuses to go away, no matter how many academics try to explain it.

Fama called it the “premier anomaly." And it’s one that I’ve staked my entire career on — momentum.

Let’s talk about it.

The Pattern That Shouldn't Exist

Here's what momentum means in plain English: Stocks that have been winning tend to keep winning.

Stocks that have been losing tend to keep losing, at least for a while. This shouldn't happen in an efficient market.

If everyone can see that a stock has been going up, why would smart money keep buying? Shouldn't they expect it to fall back to "fair value"?

Yet 2024 experienced one of the strongest momentum runs of the past 30 years.

The AI boom created exactly the kind of explosive moves momentum traders dream about — stocks rising not because of subtle improvements in fundamentals, but because capital itself became a force multiplier.

Think about Nvidia's journey from $200 to over $900 in less than a year.

Or the lesser-known names that rode the AI wave, companies building data centers, cooling systems, and networking infrastructure.

Many of these moves weren't driven by patient value investors poring over spreadsheets.

They were driven by what traders call "price action" — the raw force of buying pressure creating its own momentum.

The Academic Backbone

The funny thing about momentum is that it's one of the most heavily researched phenomena in all of finance.

It's not some fringe theory cooked up by day traders. It's been validated across:

- Multiple decades of data

- International markets from Asia to Europe

- Different asset classes (stocks, bonds, commodities, and currencies)

- Various holding periods from weeks to months

The seminal research came in 1993, when academics Narasimhan Jegadeesh and Sheridan Titman published findings showing that buying recent winners and selling recent losers generated significant excess returns.

Their work sent shockwaves through the finance world because it directly contradicted the prevailing wisdom that markets were perfectly efficient.

What made this research bulletproof was its simplicity.

The strategy didn't require insider information, complex algorithms, or privileged access. Just basic price data — information available to anyone with a newspaper (or today, a smartphone).

When asked about momentum strategies and whether markets can be beaten, Fama responded, "Ya, Momentum is the biggest example."

Why Does Momentum Work?

If momentum is so well-documented, why doesn't everyone exploit it until it disappears?

That's the $64,000 question. Academics have offered several explanations:

Behavioral Factors: Investors systematically underreact to news.

When a company announces strong earnings, people are initially skeptical.

They wait for confirmation.

By the time the story becomes obvious, the stock has already made a significant move. But there's often more to come as late adopters finally jump in.

Institutional Constraints: Large funds can't move quickly.

By the time a pension fund approves a position in a hot stock, retail traders and hedge funds have already captured the early gains.

But paradoxically, when the institutions finally arrive with billions to deploy, they create the next leg up.

Risk and Crashes: Momentum doesn't work all the time.

It experiences periodic crashes. Sharp, sudden reversals that can wipe out months of gains in days.

Many investors can't stomach this volatility, which keeps the strategy from becoming overcrowded.

The AI Momentum Machine

Which brings us to today's market. The AI sector has become a laboratory for studying momentum in real-time.

While Nvidia saw nearly a 200% increase last year, the median semiconductor company was down — a staggering divergence that may be one for the history books.

This bifurcation is textbook momentum: Capital concentrates in the strongest names, leaving laggards behind.

It's not about which companies have the "best" technology or the most reasonable valuations.

It's about which stocks are demonstrating the strongest price action.

Look at the pattern:

- AI emerges as the dominant narrative

- Early movers establish uptrends

- Each successive wave of buyers strengthens those trends

- Traditional metrics like P/E ratios become irrelevant

- The strongest stocks pull away from the pack

This isn't just happening in obvious names like Nvidia.

It's cascading through the entire supply chain. Chip designers, foundries, data center operators, power infrastructure companies… even coffee chains are incorporating AI into their operations.

The Technical Framework

Professional momentum traders don't just buy whatever moved up yesterday.

They look for specific patterns:

Stage 1: Establishing the Uptrend. A stock breaks out from a period of consolidation on strong volume. This initial move often catches fundamental analysts off guard - the news hasn't changed, so why is it suddenly moving?

Stage 2: The Momentum Phase. Price makes higher highs and higher lows in a steady rhythm. Pullbacks are shallow and brief. This is where the real money gets made, as the trend becomes self-reinforcing.

Stage 3: The Acceleration. This is what traders sometimes call a "vertical move" or "parabolic phase." Price gaps up on huge volume. Everyone who was skeptical starts feeling FOMO (fear of missing out). This phase can last days or weeks.

Stage 4: The Exhaustion. Eventually, all momentum runs end. The trick is recognizing when the character of price action changes - when dips start getting deeper, rallies become unconvincing, volume dries up.

The Options Leverage Question

Here's where momentum trading gets both more powerful and more dangerous: options.

When you buy a stock, your potential gain is unlimited. But it takes substantial capital to generate meaningful returns.

A 50% move on a $10,000 position nets you $5,000. Nice, but not life-changing.

Options, however, offer leverage.

That same 50% move in the underlying stock might generate a 200% or 300% return on an options position — turning that $10,000 into $30,000 or more.

The catch? Options are wasting assets.

Every day that passes without the expected move, you lose money to time decay. And if you're wrong about direction, you can lose your entire investment.

This makes options ideal for momentum strategies in theory: You're betting on fast moves in stocks already in motion.

But it requires precision timing — getting in just as momentum accelerates, and getting out before it stalls.

What the Data Really Shows

Let's be clear about something important: While momentum as a factor has delivered excess returns historically, that doesn't mean every momentum trade wins.

Research shows that momentum strategies can experience predictable crashes, where the likelihood of loss becomes high enough that professional managers wouldn't commit their own funds. Yet, they keep clients' money invested due to competitive pressures and fee structures.

The average momentum strategy might win 55-60% of the time. But the winners can be large enough to more than compensate for the losers.

It's the opposite of picking up pennies in front of a steamroller. It's more like getting hit by small cars repeatedly while waiting for the occasional dump truck full of cash.

Recent analysis of momentum performance shows that success rates vary dramatically by market conditions.

In strong trending markets, momentum shines. In choppy, range-bound environments, it struggles.

The skill isn't just in identifying momentum — it's in recognizing when market conditions favor the strategy.

The Current Setup

So where does that leave us now, in late 2025?

Historical patterns suggest that after such strong momentum performance, a reversal often follows in the subsequent year.

That doesn't mean momentum strategies will stop working. It means the market leaders might change.

The AI trade has been extraordinary, but it's also crowded.

Everyone knows the narrative. When everyone knows something, the opportunity either needs to evolve or it needs to pause.

Smart momentum traders aren't just looking at last year's winners.

They're scanning for the next sector showing the early signs of institutional accumulation: unusual volume on up days, tight consolidation patterns after initial moves, and breadth expanding within an industry group.

That might still be AI, but perhaps in different names — the picks-and-shovels plays rather than the obvious leaders.

Or it might be an entirely different sector: gold miners, biotech, crypto-related stocks, or something we're not even thinking about yet.

The Bottom Line

Momentum trading isn't a magic formula. It's what Eugene Fama called "the premier anomaly" — a persistent market pattern that offers opportunity but comes with significant risk.

If you're considering a momentum approach:

Do:

- Understand you're trading price action, not fundamentals

- Use proper position sizing (never bet the farm on one trade)

- Have a clear exit strategy for both wins and losses

- Recognize that options magnify both gains AND losses

- Accept that even good strategies go through rough patches

Don't:

- Expect to win on every trade

- Ignore risk management because you're "sure" about a setup

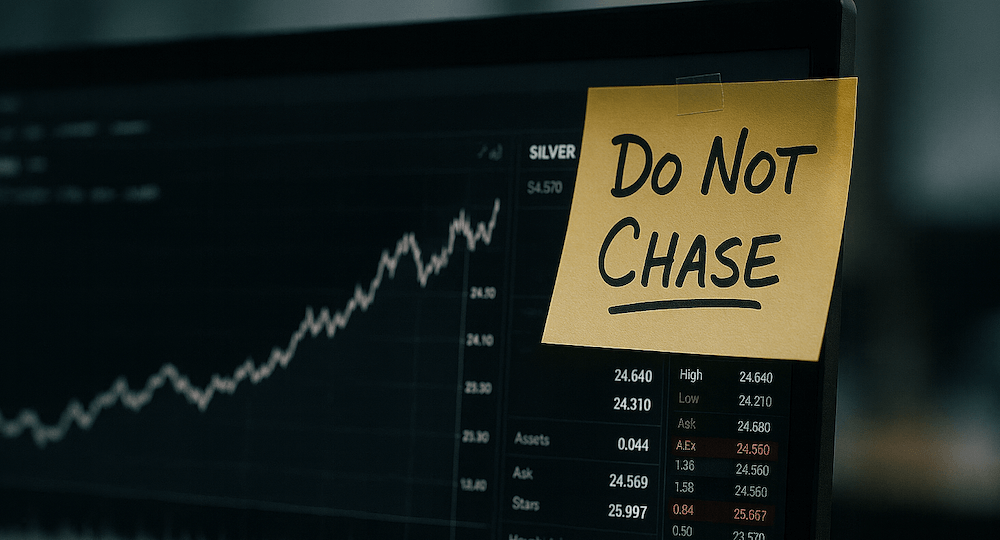

- Chase moves that have already gone vertical

- Trade with money you can't afford to lose

- Forget that past performance never guarantees future results

We’ll dive more into some of these themes in the next few weeks.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Leverage Trap: A Painful Lesson in Risk

Posted October 17, 2025

By Greg Guenthner

4 Hard Truths for a Parabolic Market

Posted October 16, 2025

By Enrique Abeyta

Death By Greed: Silver Edition

Posted October 14, 2025

By Ian Culley

Everyone Loves the Rally…. Except the Data

Posted October 13, 2025

By Enrique Abeyta

How to Handle a Bubble — You Have Four Options

Posted October 09, 2025

By Enrique Abeyta