Posted October 05, 2025

By Ian Culley

The “Forgotten Stepchild” Precious Metal Is Waking Up

For two years, palladium has been a ghost.

While gold screamed to record highs… while silver clawed its way back toward glory… while platinum shocked the world with a 240% miner rally… palladium did nothing.

It sat buried, ignored, and forgotten.

Most traders stopped watching. Most analysts stopped caring.

But markets have a way of punishing complacency. And if history has taught us anything, it’s that when palladium wakes up, it doesn’t stroll quietly into the rally…

It explodes.

Look back at 2016. Palladium doubled in less than two years while gold and silver struggled just to keep pace. In 2019, it went on a tear so violent it left even the most seasoned metals traders stunned, rocketing 140% before anyone realized what was happening.

And right now, the technicals are lining up for that same kind of move.

A violent thrust through a three-year downtrend. The biggest single-week gain in over a decade. Twelve months of quiet consolidation - smart money building positions under the surface.

Now the coil is tightening. The pressure is building. Each test of resistance gets stronger. Each rejection, weaker.

And when the lid finally blows, it won’t be polite. It’ll be the kind of move that rips through the market overnight and makes those who hesitated wish they’d acted sooner.

Gold led. Silver followed. Platinum joined the party. And palladium — long ignored, long forgotten — is next in line.

Let’s talk about the first thing you need to do when the market opens tomorrow morning…

Precious Metals Never Rally Alone

Let's rewind to June 2019, when gold broke to a six-year high. That breakout marked the beginning of a multi-year bull run that most investors completely missed. Why? Because gold had been dead money since 2011, and no one wanted to touch it.

Fast forward to last year. After four years of choppy, sideways action, gold was putting investors to sleep. Even the most devoted gold bugs were losing faith.

Then lightning struck. Gold surged to a new all-time high and never looked back. It hit $3,000 in March of this year and continues to push higher.

I immediately started loading up on gold miners like Agnico Eagle Mines (AEM), Wesdome Gold Mines (WDOFF), and Iamgold (IAG). All have delivered solid returns.

But I was also watching the rest of the precious metals complex, waiting for them to wake up.

Here's the thing: Gold never rallies alone. At least, not for long. Broad participation across the metals complex is the hallmark of a sustainable bull market.

Sure enough, silver finally got the memo. It's now trading just three dollars away from record highs.

Platinum joined the party, too. Sibanye Stillwater (SBSW), the South African miner I've been bullish on, has rocketed approximately 240% year-to-date — crushing even the hottest quantum computing stocks.

That leaves one metal conspicuously absent from the rally: palladium.

Why Sibanye's Surge Matters

Here's where things get interesting.

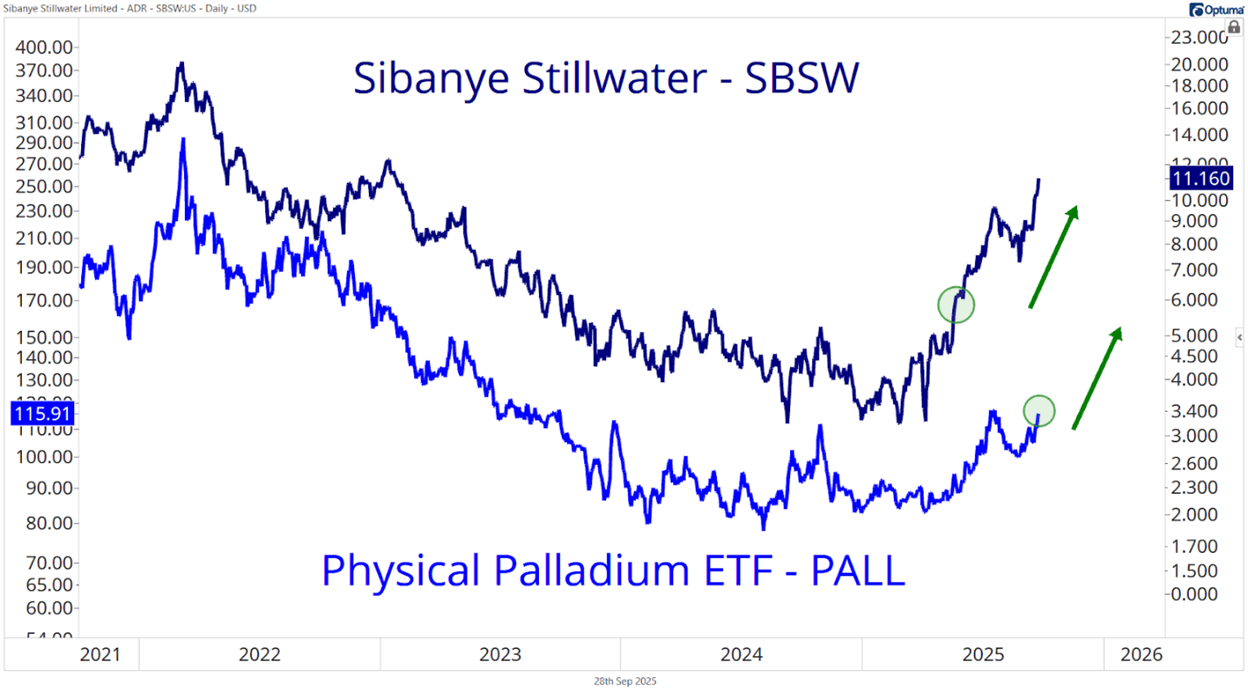

Take a look at the chart comparing Sibanye Stillwater (SBSW) with the Aberdeen Physical Palladium Shares ETF (PALL).

The two assets share an uncanny resemblance - until recently. Both spent two years in a dreary downtrend, moving in lockstep. But now they're diverging in a meaningful way.

Sibanye has reversed sharply higher, joining gold and silver's rally with explosive momentum. Meanwhile, the palladium ETF has barely budged.

Why does this matter? Because Sibanye is a major palladium miner. When the mining stock starts outperforming the underlying metal, it's often a leading indicator that the metal itself is about to play catch-up.

Think of it this way: The smart money is already positioning in the miners, anticipating the move in palladium. The metal always follows.

Gold led. Silver followed. Platinum is catching up. Now it's palladium's turn.

The Technical Setup: Reading the Candle

Before you rush to buy the dip on any beaten-down asset, you need confirmation that the trend has actually reversed. Without it, you're just catching a falling knife.

The good news? Palladium is giving us that confirmation.

Last September, PALL violated a three-year downtrend line with authority. The bulls drove prices 17% higher that week—the largest weekly gain of 2024. These singular thrusts, whether on weekly, daily, or even intraday charts, often mark the beginning of a new trend.

But a trendline break alone isn't enough to pull the trigger. It's a warning shot, not a buy signal.

After that initial spike, PALL spent the next 12 months consolidating as strong hands accumulated positions. That's exactly what you want to see. It's the foundation being laid for the next leg higher.

Now, PALL is challenging a shelf of former highs for the fourth time in two years. Each time it's tested this resistance, it's held firm—until now.

The metal is coiling tighter. Pressure is building. And when it finally breaks, I expect it to move with conviction.

How to Play the Palladium Breakout

I'm watching PALL closely for a decisive break above this multi-year resistance zone. I don't want a wimpy, half-hearted push higher.

I want to see a big, fat green candle that blows through those former highs with authority.

That's the signal I'm waiting for.

When palladium thrusts above this range with conviction — ideally on strong volume — that's when the risk/reward becomes compelling.

That's when you know the final piece of the precious metals puzzle is clicking into place.

You can play this move through the Aberdeen Physical Palladium Shares ETF (PALL), which tracks physical palladium prices.

Or if you want more leverage, consider miners like Sibanye Stillwater (SBSW), which has already started its move.

The setup is there. The fundamentals support it. The technicals are aligning.

All we need now is that one decisive candle — the kind that appears on your screen and makes you wish you'd already pulled the trigger.

Don't miss it when it comes.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Leverage Trap: A Painful Lesson in Risk

Posted October 17, 2025

By Greg Guenthner

4 Hard Truths for a Parabolic Market

Posted October 16, 2025

By Enrique Abeyta

Death By Greed: Silver Edition

Posted October 14, 2025

By Ian Culley

Everyone Loves the Rally…. Except the Data

Posted October 13, 2025

By Enrique Abeyta

How to Handle a Bubble — You Have Four Options

Posted October 09, 2025

By Enrique Abeyta