Posted January 19, 2026

By Enrique Abeyta

“TACO” Out… “Big MAC” In

The Trump administration has one objective for the year, and that’s winning the midterm elections.

With each new week, we seem to get another policy announcement aimed at affordability to win over voters.

Trump recently floated the idea of a one-year cap on credit card interest rates at 10%. Whether that actually comes to pass, the message is clear…

The administration wants voters to know it’s fighting rising costs, even if the methods are unconventional.

And this message has not gone unnoticed.

A New Trump Trade Emerges

Trump’s new emphasis on affordability inspired economist Claudia Sahm to coin a new phrase: the “Big MAC Trade,” short for midterms are coming.

This new term follows in the footsteps of last year’s “TACO Trade,” short for Trump always chickens out.

The TACO Trade described a pattern where bold policy threats were either softened or reversed after adverse market reactions.

Big MAC takes that idea a step further, suggesting that the latest proposals are driven less by long-term economic design and more by short-term political necessity.

Rising costs remain one of the most emotionally charged issues for voters, cutting across income levels and political affiliations.

Credit-card balances are high, housing remains expensive, and consumers are increasingly sensitive to interest rates.

Addressing those pressures, even symbolically, is a logical political strategy heading into November.

That’s why the structure of the credit-card proposal matters as much as the proposal itself.

A one-year cap on credit-card interest rates makes little sense as serious economic reform.

If such a cap were truly beneficial and sustainable, it wouldn’t be temporary. The one-year duration lines up neatly with the election calendar, not with economic logic.

That distinction is critical for investors. It helps separate political signaling from policies likely to reshape entire industries.

The broader macro backdrop reinforces this interpretation.

Running the Economy Hot (On Purpose)

Historically, presidents have had limited influence over the economy because fiscal, monetary, and credit policies operate independently.

In 2026, that separation is breaking down.

Fiscal policy is turning more stimulative through new deductions and changes to withholding that will boost take-home pay and tax refunds.

Credit policy is loosening as regulators ease capital requirements, roll back enforcement, and encourage lending.

Even monetary policy is under pressure, with the White House openly favoring easier financial conditions over restraint.

When all three levers move in the same direction, the economy can run hotter than usual, at least in the short term.

That’s a feature, not a bug, of an election-year strategy.

Markets, however, don’t wait for legislation to pass. They trade expectations, probabilities, and fear.

That was on full display after the credit card announcement.

Stocks of global payment and credit giants like Visa sold off sharply as investors rushed to price in worst-case scenarios.

Would profits be capped? Would lending shrink? Would regulation suddenly tighten?

In a matter of hours, a theoretical proposal translated into billions of dollars in lost market value.

This is where experience and discipline matter.

Election-year politics reliably produce exaggerated market reactions. In many cases, the initial move is the most emotional.

That doesn’t mean these announcements should be ignored. It means they should be contextualized.

Understanding the political motivation behind them helps investors assess whether a selloff reflects real long-term risk or temporary uncertainty.

The Big MAC Trade offers a framework for doing exactly that.

Turn Midterm Madness to Your Advantage

As midterms approach, affordability-focused announcements are likely to keep coming. Each one may spark volatility.

And each one may create opportunities for investors willing to look past the headline and focus on business fundamentals.

None of this eliminates risk.

Running the economy hot, loosening credit, and prioritizing short-term growth come with long-term consequences.

But markets have a long history of postponing those worries, especially when growth and liquidity remain supportive.

For now, the dominant force is political urgency. And political urgency creates motion.

At Truth and Trends, our role is not to get swept up in the drama, but to translate it into actionable insight.

Election-year politics may be noisy. But noise creates movement, and movement creates opportunity.

As the Big MAC Trade gains traction heading into the midterm elections, we’ll continue to look for ways to trade the political chaos.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Forget the Noise, You're Not Bullish Enough

Posted January 29, 2026

By Enrique Abeyta

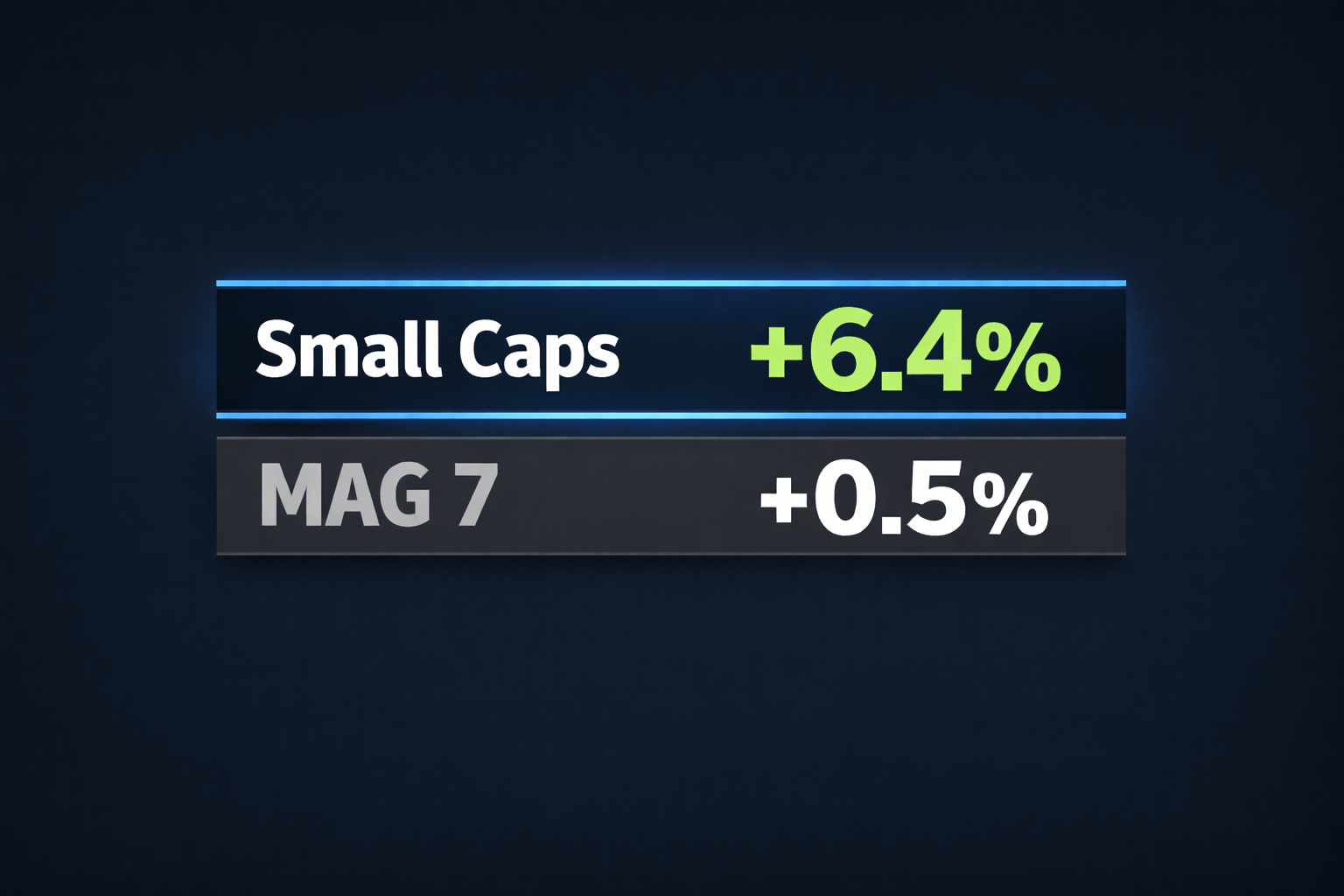

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner

What to Do While Silver Goes Vertical

Posted January 16, 2026

By Greg Guenthner

Insider Trading From Hamilton to Pelosi

Posted January 15, 2026

By Enrique Abeyta

“BTSD” — The Powell Probe Trade

Posted January 12, 2026

By Enrique Abeyta