Posted July 03, 2025

By Enrique Abeyta

STOCK WARS: Independence Day Edition

Tomorrow is Independence Day. To celebrate, I wanted to take a moment to talk about why America is one of the best places on Earth to live.

And for our purposes here at Truth & Trends, it's also the best place to be as an investor.

Yes, this has been the year of the “sell America” trade. Foreign stocks have been outperforming the S&P 500 this year.

Meanwhile, the U.S. dollar is having its worst start to a year since 1973. It’s been under constant pressure as capital flows overseas in search of “better opportunities.”

If you only looked at this year’s headlines, you’d think the American century is over. But step back, and the picture changes.

Despite the noise, the U.S. is still the best place in the world for long-term investors. I’ll prove it with the numbers in just a moment.

But first, let me tell you what America means to me personally.

Living the American Dream

Longtime readers know I have a very American story.

My grandfather's family, a combination of Pueblo Indian and Spanish, has been in this country since the late 17th century.

The Pueblo have been there for about 7,000 years, and the Spanish date back to 1692 in New Mexico.

My grandmother's family was Scottish and German immigrants from the Midwest and the West. This family grew up very poor, with a long history of substance abuse.

My father had six brothers, two of whom died before they turned 35 and several who spent much of their lives in prison.

My mother's family was from Uruguay, immigrants from the Basque Country and Brazil, and was much better off.

My grandfather was the CEO of the country's utility company and one of the founders of the most prominent liberal political party in the 1970s.

Unfortunately, his timing wasn't great as a military dictatorship took over the country. My uncle was jailed for seven years as a "terrorist," and my family's house was regularly strafed with machine-gun fire by the "milicos."

My mother got stuck here in the early 1970s. She would have been jailed if she had returned to her home country.

Instead, she met my father at a hair salon (he was a successful hairdresser) and they got married to keep her here.

We had it very rough as my father's legacy trauma continued to haunt us and led to a volatile life, including living in dozens of places, going bankrupt multiple times, and briefly experiencing homelessness.

My first blessing, however, was my mother. She was an absolute rock and fought hard to get the two of us out of our terrible situation.

My second blessing was being born in America.

Back in Uruguay, my mother would have been imprisoned and probably would have died. Not to mention, the health care she received here also saved her life many times versus what she would have received there.

Despite the volatile environment my father created, America allowed my mother to have a career, it allowed me to get an excellent education, and it allowed us to pull ourselves out of poverty and violence.

A lot of people talk about how life is better in other countries. And I'm not saying the U.S. is the only great country in the world.

But I don't think there's another place where we would have had the opportunity for my mother to survive and thrive and for me — a poor Hispanic kid from Phoenix — to go on to become a successful Wall Street investor for more than two decades.

And while we could debate whether the U.S. is the best place on Earth, there's no debating that it's the best place to invest.

America Is Still the Place to Be

I went back and compared the S&P 500, the benchmark U.S. index, to other major stock indexes worldwide using Bloomberg's data.

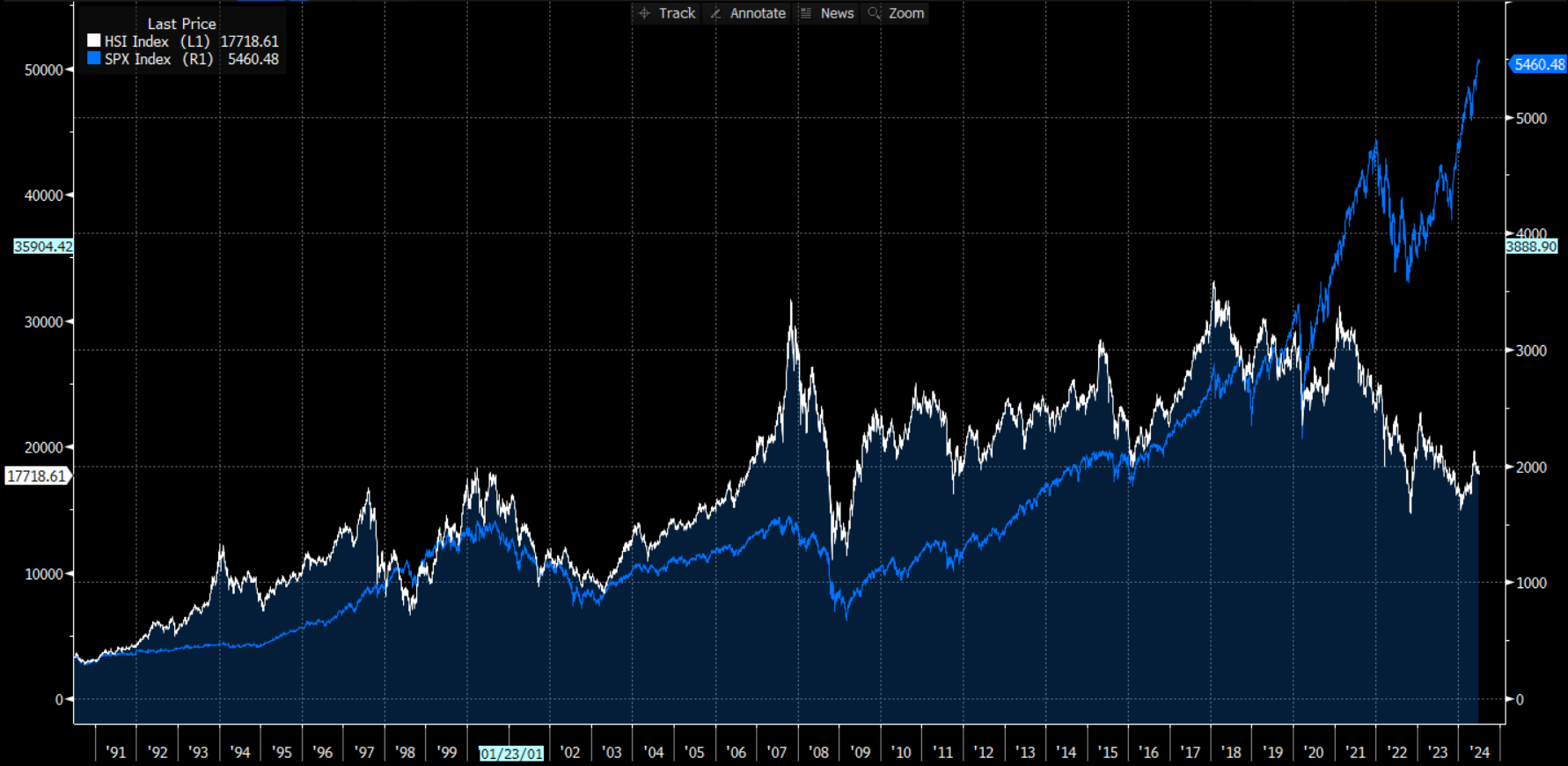

I used the STOXX Euro 600 Index as a proxy for Europe, the MSCI Emerging Markets Index for emerging markets, the Nikkei 225 for Japan and the Hang Seng Index for China and Hong Kong.

Let's look at how the S&P 500 performed against each.

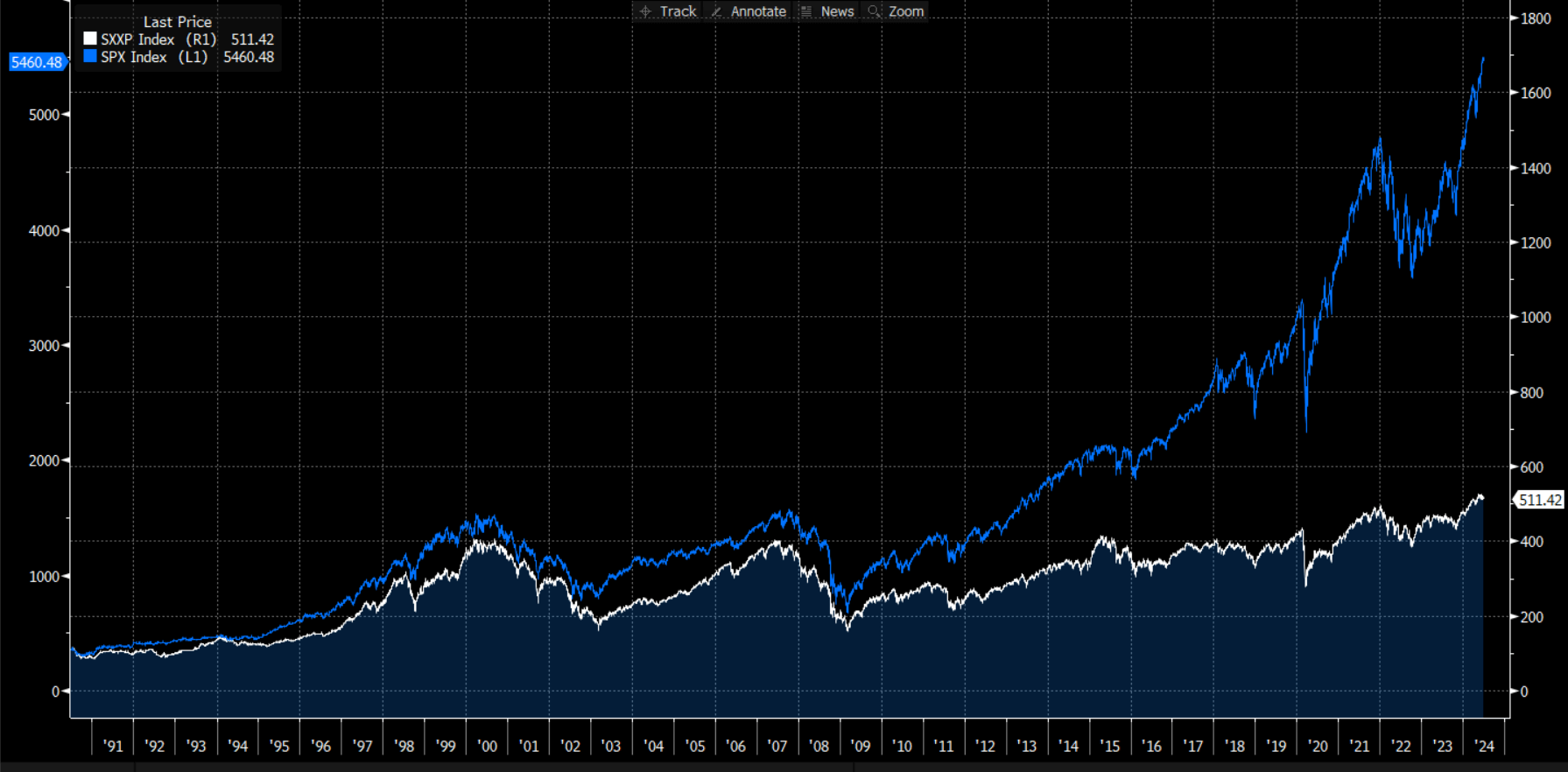

The S&P 500 vs. The STOXX Euro 600 Index

Going back 35 years, U.S. stocks have more than quadrupled the performance of European stocks.

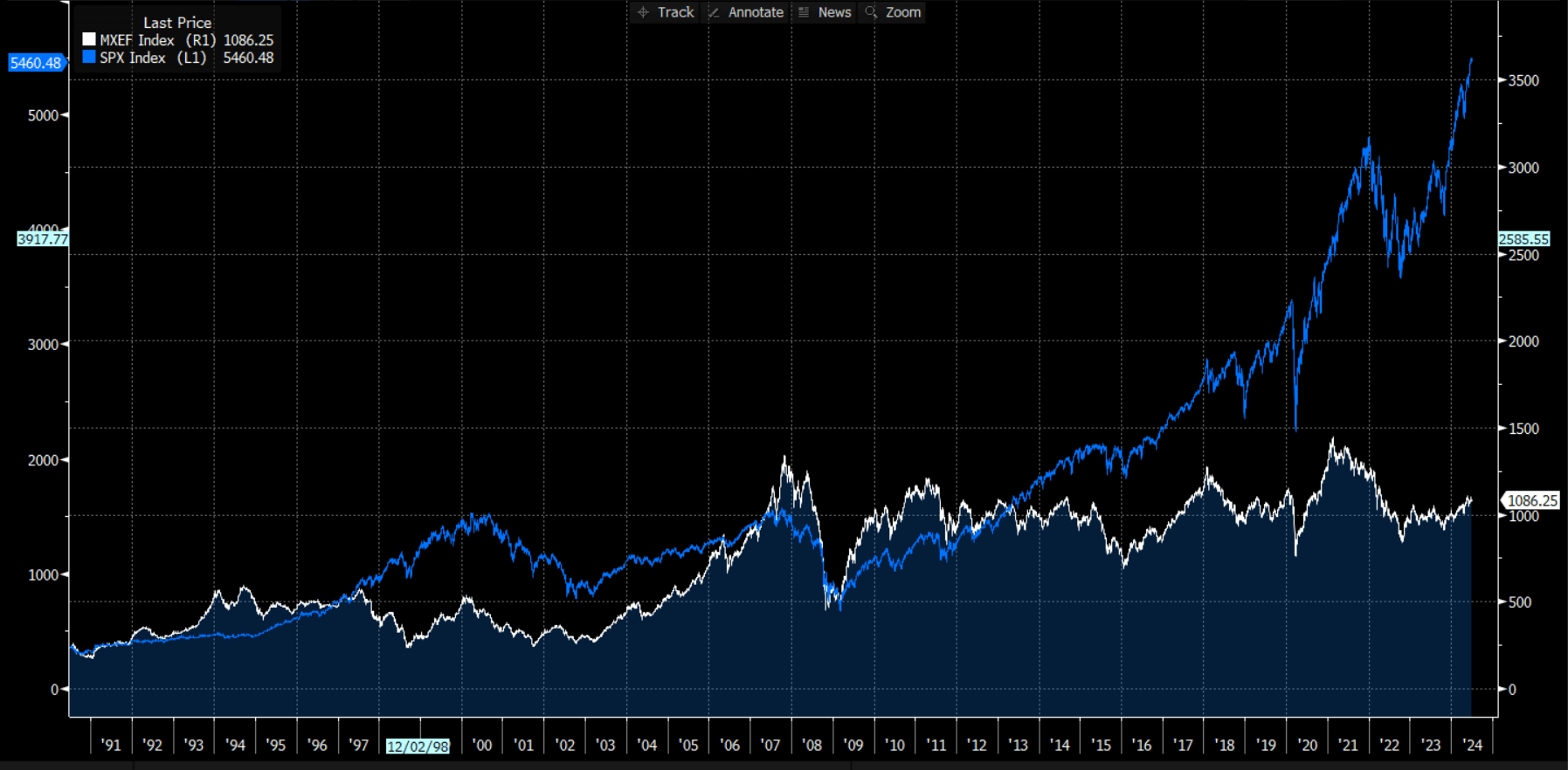

The S&P 500 vs. The MSCI Emerging Markets Index

Across the same period, they've also outperformed emerging markets by more than quadruple.

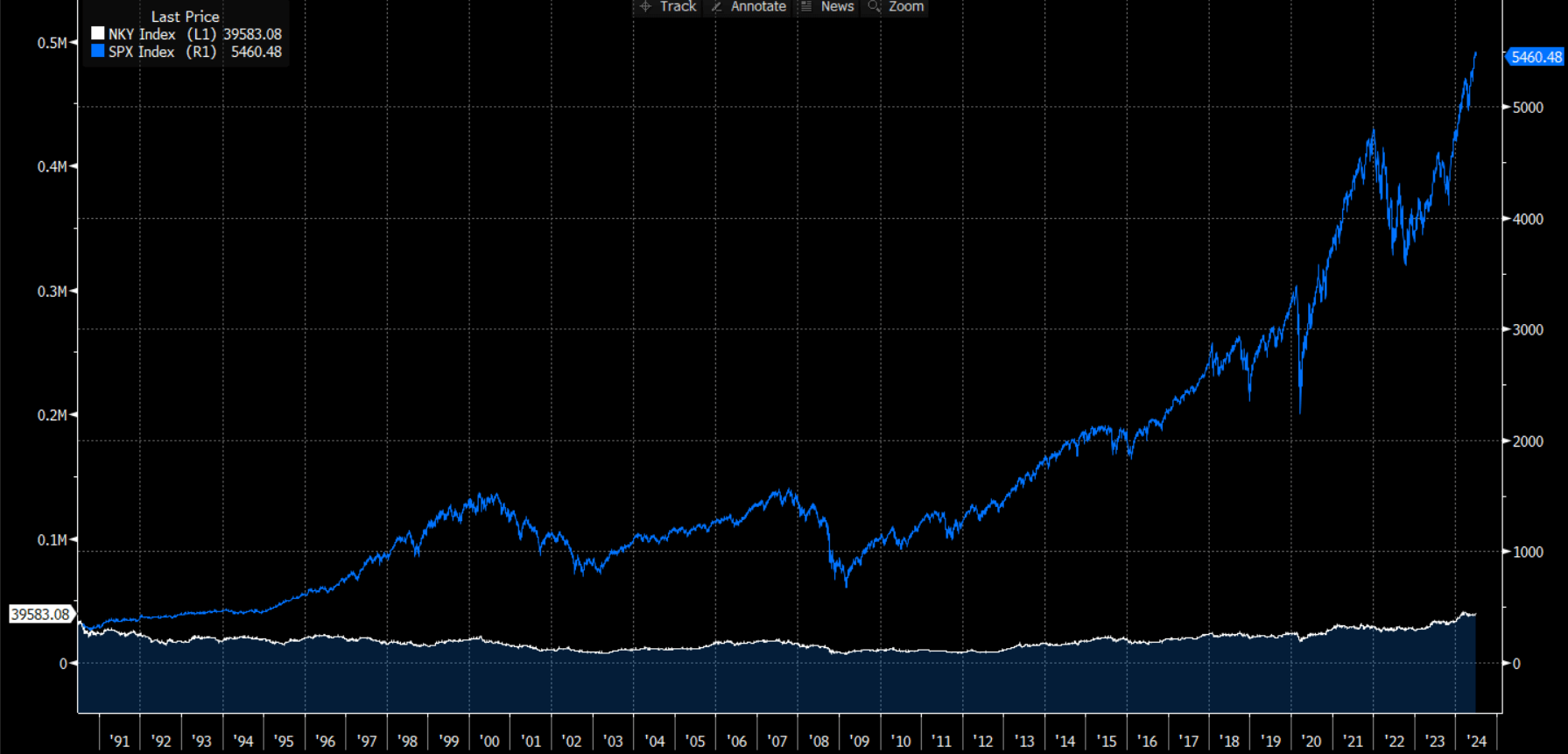

The S&P 500 vs. The Nikkei 225

The same is true of the S&P’s performance compared to Japanese stocks dating back to 1990.

The S&P 500 vs. The Hang Seng Index

The Hang Seng Index is not the best measure for China. But the S&P 500 has outperformed that by more than three times.

The data paints a clear message.

Over a significant sample size, U.S. stocks have been the best place for long-term investors. This is even with the recent rally in foreign markets.

Even after “sell America trade,” the U.S. still has a clear lead over foreign markets. Of course, this is all historical performance.

But this Independence Day, I want to remind you that the U.S. remains a great place to live and invest.

I hope you enjoy the long holiday weekend.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

![[Breakout Confirmed] This 10x Trade Is Taking Off](http://images.ctfassets.net/vha3zb1lo47k/5SZCYl7OZbRTZpXv6ItiqQ/fcc3fb7ac31039e02a1e4ef1ff161ca5/ttr-issue-07-01-25-img-post-2.jpg)

[Breakout Confirmed] This 10x Trade Is Taking Off

Posted July 01, 2025

By Ian Culley

Elon Musk Changed My Life Forever

Posted June 30, 2025

By Enrique Abeyta

How I Build MONSTER Positions

Posted June 27, 2025

By Greg Guenthner

Ken Griffin Is Full of Sh*t

Posted June 26, 2025

By Enrique Abeyta

The “Wall of Worry” Climb Is Over

Posted June 24, 2025

By Ian Culley