Posted August 14, 2025

By Enrique Abeyta

Small Caps Suck… Until They Don’t

The Russell 2000, the benchmark for small-cap stocks, saw a huge move this week.

By Wednesday’s close, the index was up 4.8% from Monday’s open.

That’s surprising given the fact that the index consists of some of the worst stocks on Wall Street.

Around 40% of the companies in the Russell 2000 lose money compared to 6% of S&P 500 companies.

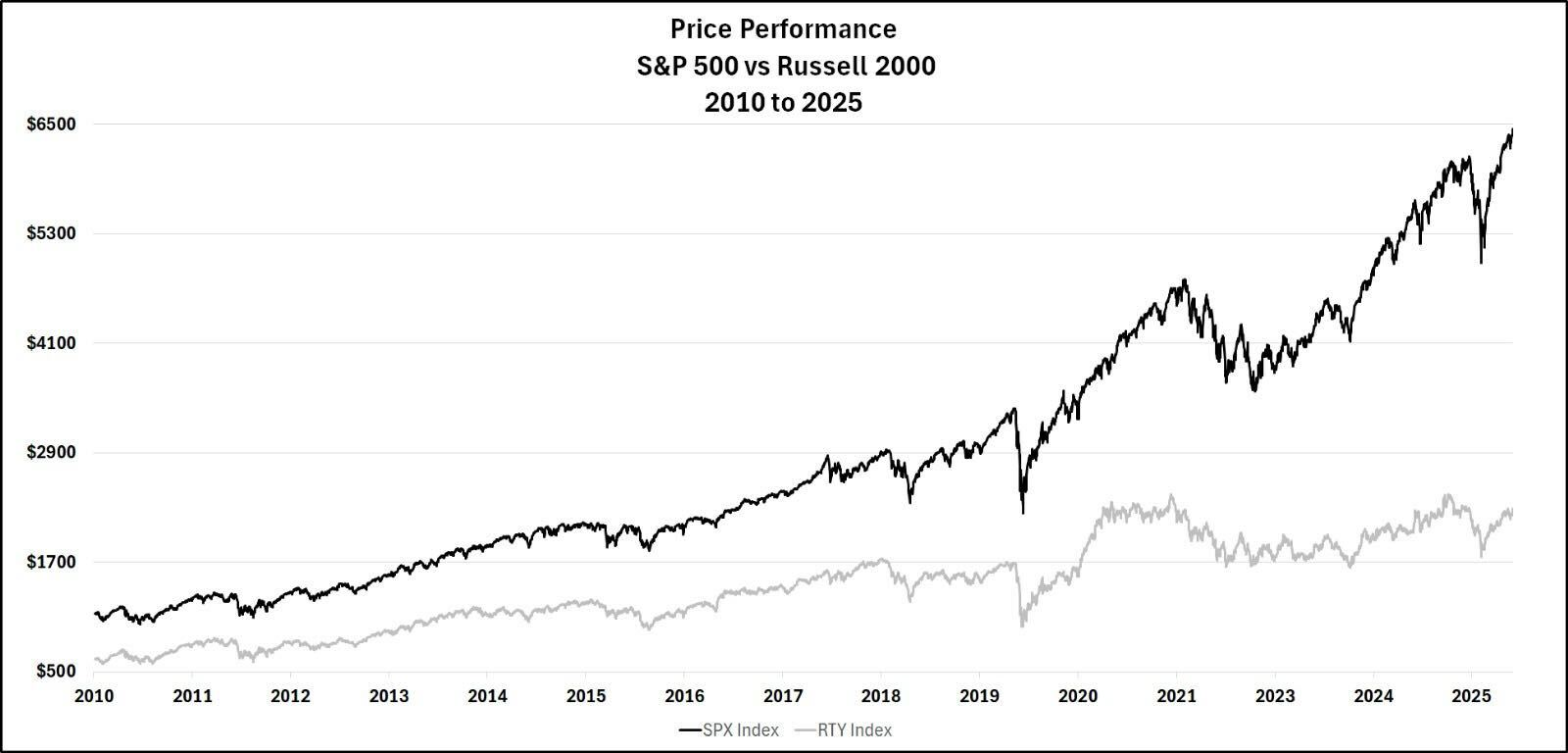

And the index has badly lagged behind the broad market over the last decade.

In other words, small caps suck. But the fact remains that they are getting more attention this week.

So what’s behind this latest move…and is it the start of something bigger?

Today’s Laggards Could Be Tomorrow’s Leaders

The components of the major stock market indices are a “black box” to most investors.

Although we talk about them all the time — the S&P 500, the Dow Jones, the Nasdaq, the Russell 2000 — most folks don’t really know what goes into them.

So let’s start with what the Russell 2000 actually is. It’s made up of the smallest two-thirds of the Russell 3000, a more comprehensive index of the largest U.S.-listed companies.

The total market cap of the entire Russell 2000 index is a little less than $3 trillion. So every company in the index combined is valued less than Nvidia, Microsoft, and Apple individually.

And the combined net income of all 2000 companies is approximately $80 billion for a full year, compared to over $100 billion for each of the large companies above.

While the Russell 2000 tracks more companies than the S&P 500 or the Dow Jones, it’s less representative of our economy based on the numbers.

Now, that doesn’t mean the smaller companies aren’t important. But it does give some important context.

The Russell 2000 itself also suffers from what’s called a “negative selection bias.”

When a company is very successful, its market cap grows. Eventually, it becomes so large that it qualifies to be a part of the larger-cap Russell 1000.

In other words, the Russell 2000 is built to lose its best companies!

The reality for the companies in this index is that they are sub-scale and don’t have the same access to resources that the larger companies have.

Given their smaller size, they are also more vulnerable to fluctuations in both interest rates and commodities.

If you were to imagine the economy as an ocean, they are the small ships sailing alongside the massive freighters and cruise ships.

A big storm (a recession) can send many of them to the bottom of the ocean.

Once you understand the makeup of the Russell 2000, it makes sense why they have underperformed the broad market since the global financial crisis.

Again, unprofitable companies make up nearly half of the index. And the negative selection bias means the companies that do the best are removed from the index.

Over the past 15 years, the S&P 500 is up 500% while the Russell 2000 is up a little more than half that at 265%.

I mention all of this because of the huge move in small caps earlier this week.

The reason small caps were up so much is that investors are anticipating rate cuts, which could act as a tailwind for this group of stocks.

Compared to their larger peers, small caps have more sensitivity to interest rates in their results. Their balance sheets are not as strong, and they don’t have the same access to capital.

While the current level of interest rates isn’t hurting these companies, lower interest rates could help them tremendously.

So investors are getting excited about the possibility that the underperformance in small caps may finally reverse.

Imagine the ocean example from earlier. With calm seas and strong winds, smaller ships could go much faster than the large ones.

The environment would be good for both, but the sensitivity of the smaller ships (or companies) is much greater.

If the Fed cuts rates into a stable, growing economy, then the market’s weakest stocks could become the fastest movers.

And when that shift happens, you’ll want to be ready for it.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Labor Is Capitalism: A Tribute to Work

Posted September 01, 2025

By Enrique Abeyta

The Alt Energy Bet That’s Already Lost

Posted August 31, 2025

By Chris Cimorelli

Biotech Bombshell 💣

Posted August 29, 2025

By Greg Guenthner

Julian Roberston and the Discipline That Built Billions

Posted August 28, 2025

By Enrique Abeyta

Ditch Nvidia Tomorrow Night

Posted August 26, 2025

By Ian Culley