Posted January 23, 2026

By Greg Guenthner

Small Caps Are Back, Baby!

Panic. Confusion. A market on the brink.

That’s all the financial media wanted you to see during Davos this week. They were obsessed with the "Distractor-in-Chief" and his wild talk of a hostile Greenland takeover.

Stocks skidded. The herd feared the worst. It felt like the sky was falling.

But then, less than 48 hours later? Silence.

After a quick "productive meeting" with NATO, the tariff threats were walked back, the crisis vanished, and the whole thing was revealed as nothing more than smoke and mirrors.

Now, here’s the part they didn't tell you…

Trump’s comments might have greenlit a snapback rally for the big guys, but the real story was elsewhere.

While the "safe" mega-caps and crypto darlings were wobbling, one specific group of stocks used the “mini-panic” as a launchpad.

And it has nothing to do with AI or crypto.

I’m talking about small-cap stocks.

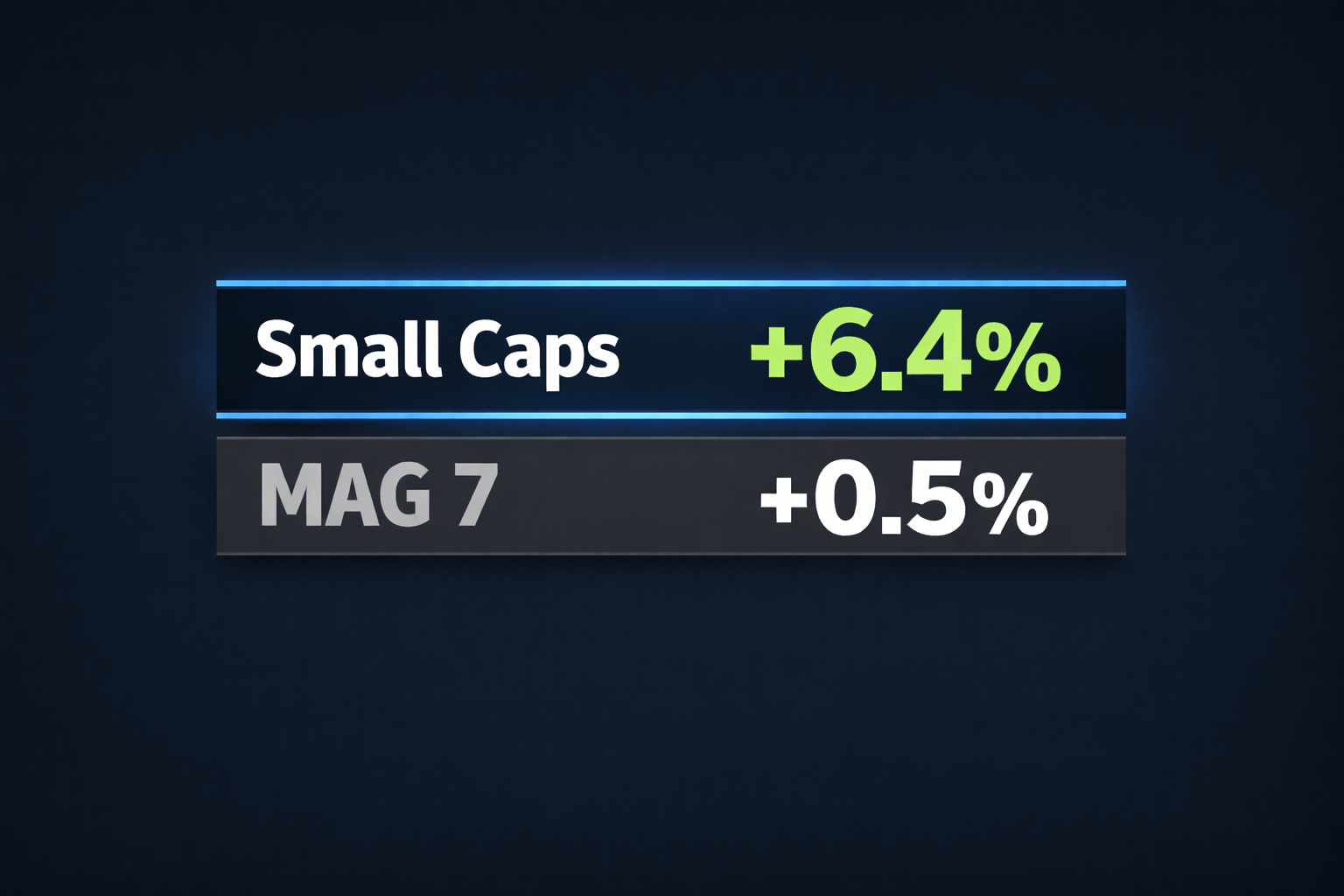

The numbers don’t lie. Small caps are outperforming their bigger cousins and extending to new all-time highs, ignoring the noise and turmoil that’s produced choppy trading action this week.

The small-cap Russell 2000 jumped an impressive 2% on Wednesday, marking its 13th straight day logging a stronger return than the S&P, according to CNBC. This matches the Russell’s longest outperformance streak since June 2008.

It’s been a hot minute, but small caps are back, baby! And this rally is just getting started.

It’s Been a Long Time Coming

Before we get to some fun charts, I have to remind you how downright terrible small caps have looked over the past several years.

As recently as five months ago, the “Rusty Russell” was still trading right where it was at its February 2021 peak.

That comes to more than four years of sideways chop, including a nasty failed breakout immediately following the 2024 election rally that kicked off what would soon become a tariff tantrum meltdown that shaved 30% off the Russell in just four months.

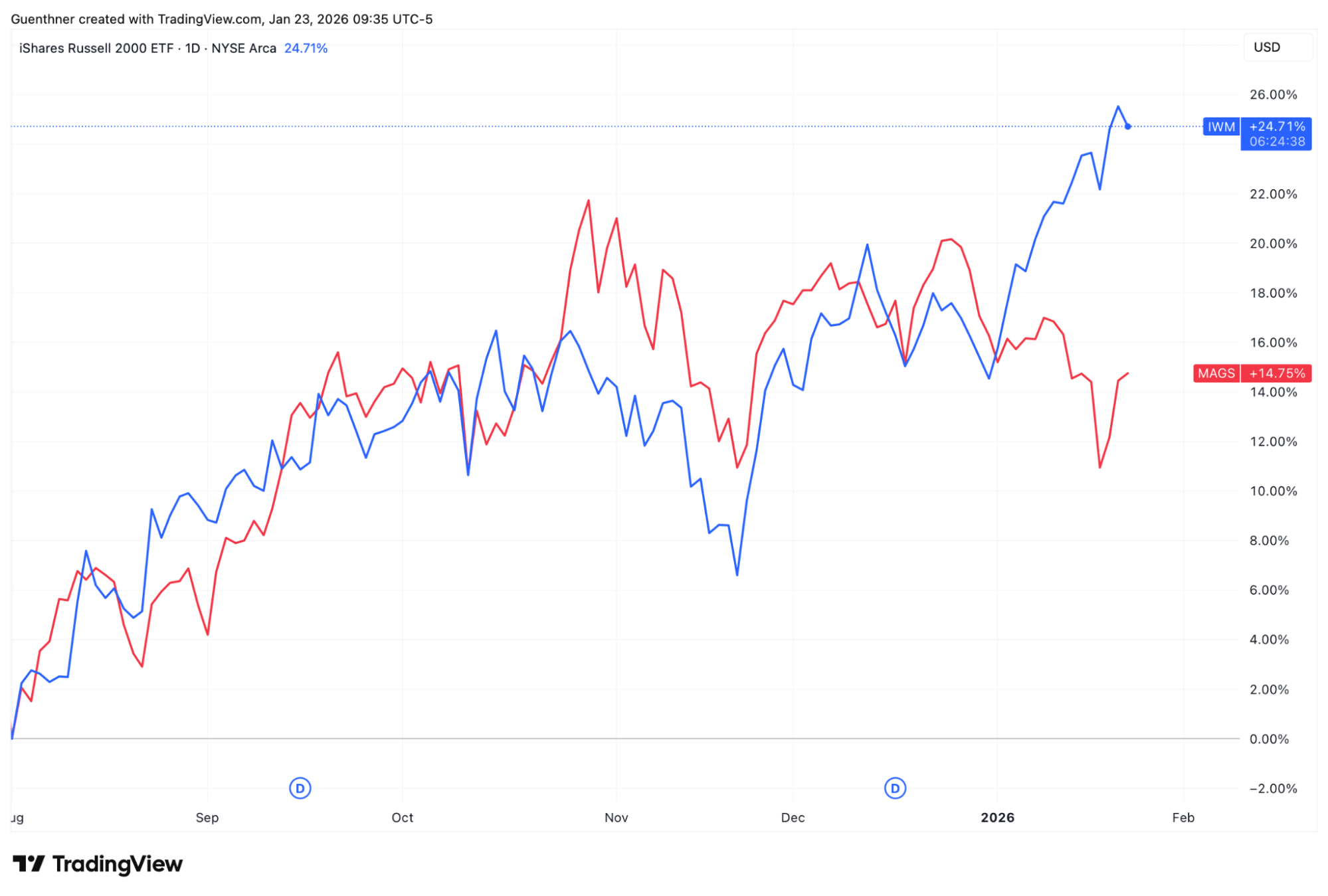

But small caps have clawed their way out of this pit of despair, and the iShares Russell 2000 ETF (IWM) is finally posting a breakout that’s managed to stick.

There were rumblings of a major small-cap move late last year as stocks recovered from their fall skid. IWM briefly posted new all-time highs in early December, but couldn’t extend the rally into the holidays.

That changed when the calendar flipped to 2026. The Russell caught fire on the first day of January and hasn’t looked back since. IWM has rallied 9% year-to-date, easily crushing the performance of the S&P and Nasdaq Composite (both are teetering near breakeven).

More importantly, smaller stocks are smoking the mega-caps. Just look at how IWM and the Magnificent 7 names have decoupled in January.

The small-cap ETF (blue line) has been hot out of the gate, while the Roundhill Magnificent Seven ETF (MAGS) is red on the month.

For the record, I don’t think we should be too worried about a bigger breakdown in the Mags.

Sure, they could endure some chop during the first half of the year. But the real threat is underperformance.

Even if the big boys manage to eke out some gains in the months ahead, they could continue to lag the smaller stocks catching a bid right now.

The message to active traders is clear. Rotate down to smaller names that are relative winners in this tape.

Fueling the Small-Cap Fire

There are two groups of stocks helping to power small caps higher: regional banks and biotechs.

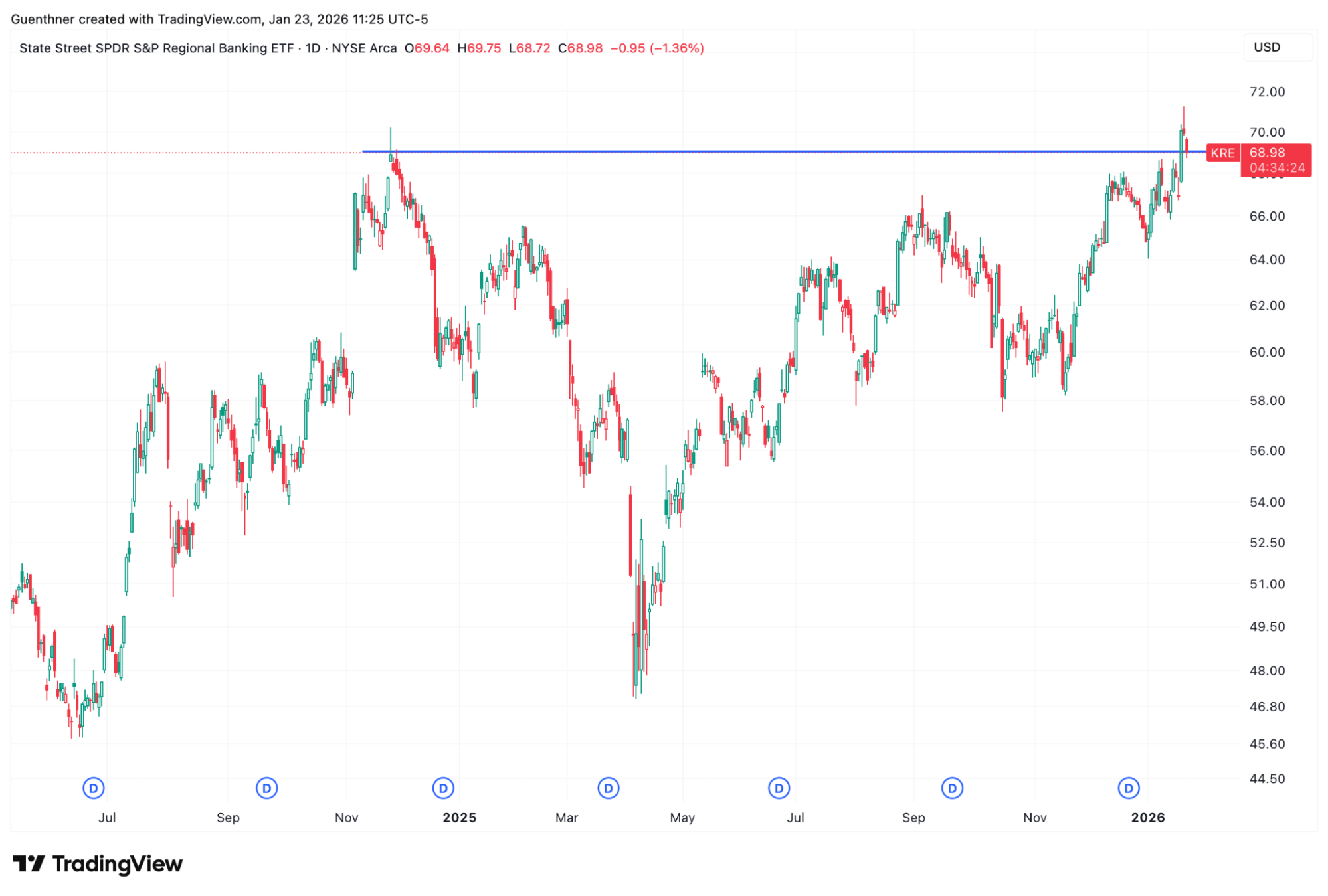

Let’s start with the banks first. Financials are the third-largest sector in the Russell, making up approximately 15% of the index. As IWM takes off this month, it’s not surprising to see the State Street SPDR Regional Bank ETF (KRE) posting a major breakout.

KRE is retesting a major breakout level near $70 heading into the weekend (it has just broken above this mark earlier in the week for the first time since November 2024).

It’s also important to note that regional banks have been downright terrible investments this decade. In fact, KRE still needs to rally nearly 15% from current levels to get back to its January 2022 highs.

With the market in “rotation mode” so far this year, recent outperformance suggests there’s still plenty of room to run.

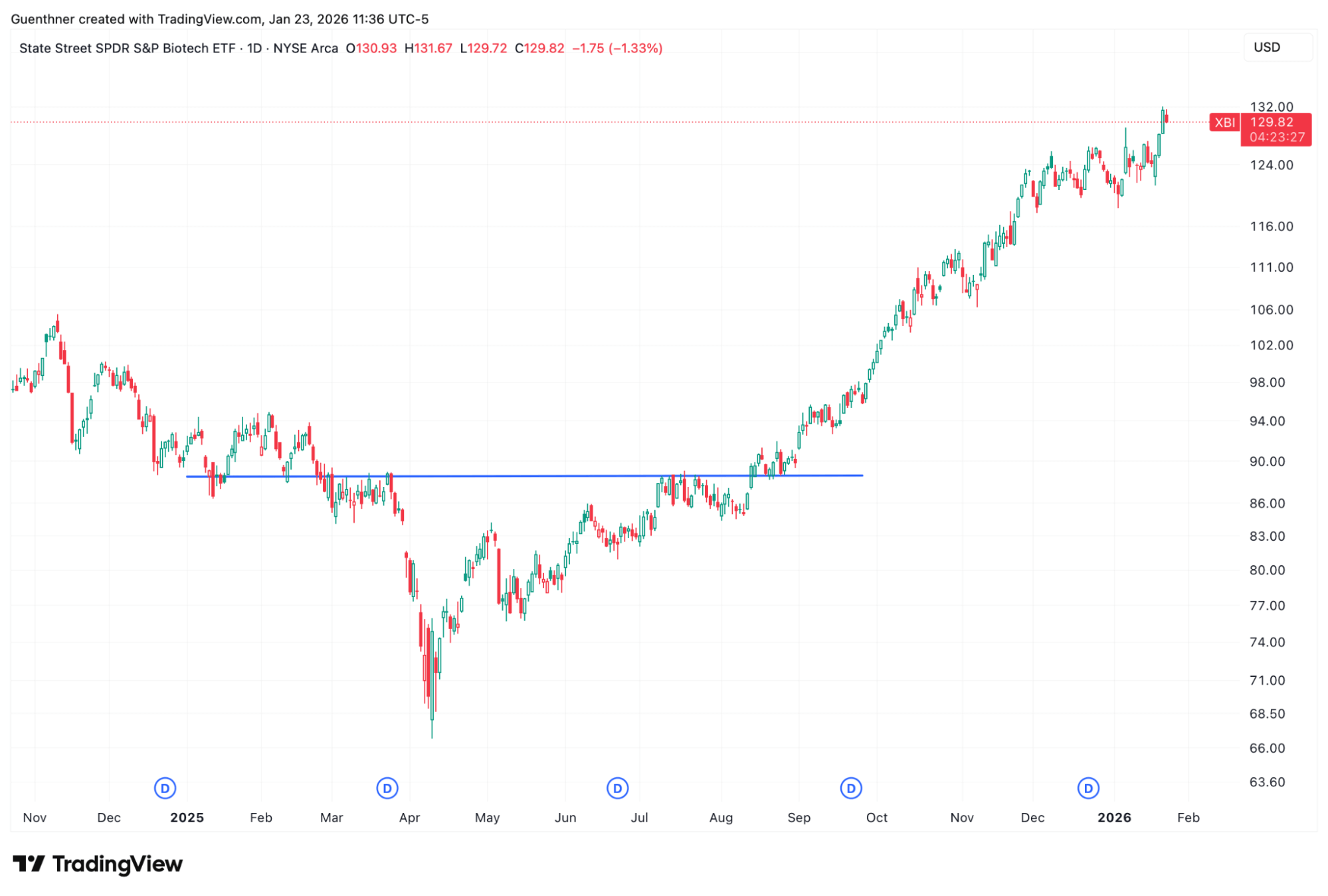

Next, we have biotech. To be blunt, biotechs as a group have been irrelevant for the majority of the past decade.

Yes, the State Street SPDR S&P Biotech ETF (XBI) enjoyed a strong rally during the COVID bubble. But it fell flat on its face after topping out in early 2021 and subsequently lost 65% of its value over the next 15 months.

XBI is still fighting back toward those 2021 highs. It still has a lot of work left to do, but the incredible uptrend it has produced since breaking out in August 2025 has been nothing short of impressive.

XBI has rallied 50% over the past six months. It’s also up 4.5% this week, breaking out of its short-term consolidation pattern. Should this breakout hold, $170 will be in play by the second quarter.

Financials and biotechs are the clear winning spots to go fishing for small-cap winners this month.

Bottom line, you don’t want to get stuck in the Mags chop. So rotate into these new market winners to stay ahead of the herd in Q1 and beyond.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Greenland, Carry Trades, and Lazy CNBC Takes

Posted January 22, 2026

By Enrique Abeyta

“TACO” Out… “Big MAC” In

Posted January 19, 2026

By Enrique Abeyta

What to Do While Silver Goes Vertical

Posted January 16, 2026

By Greg Guenthner

Insider Trading From Hamilton to Pelosi

Posted January 15, 2026

By Enrique Abeyta

“BTSD” — The Powell Probe Trade

Posted January 12, 2026

By Enrique Abeyta