Posted February 02, 2026

By Enrique Abeyta

Silver's Swan Dive Is Just the Beginning

Last Friday was the 92nd anniversary of the first radio broadcast of The Lone Ranger.

While I never listened to it on the radio, I can still hear the catchphrase from the iconic TV series to this day…

“Hi-Yo Silver! Away!”

I saw that fact on Friday morning and thought it was interesting. Little did I know that the day would also be a historical one for silver (the metal, not the horse).

Silver had been on a steep climb for months. Then on Friday, the precious metal crashed 31% — its second-worst day ever.

Silver futures ended Thursday at more than $114 a troy ounce. By the following day, silver futures ended at $78.29.

That single-day drop of $35.76 was more than the price of an ounce back in June!

Given these historic moves in both directions, I wanted to share my thoughts on what just happened with silver.

And I’ll give you some guidance if you’re a long-term investor and not sure what you should be doing right now.

The Bull Market Is NOT Over

Despite last week’s dramatic crash and all the volatility that lies ahead, the multi-year bull market in silver is not over. In fact, it may still be in its early innings.

There are several reasons why this strong uptrend started in the first place, including:

Supply Constraints: The silver market has just entered its fifth year of deficit. Simply put, demand is greater than new supply. After years of underinvestment, this will take many years to solve.

Demand Growth: Unlike gold, silver has many industrial uses. In particular, it’s used in electric vehicles, solar panels, and AI infrastructure. This has led to growing demand despite the constrained supply.

The “Debasement Trade”: This is the concept that governments (including the U.S.) will continue to print more and more money. When they do, the value of that money goes down. Especially compared to precious metals, where supply is decreasing. More dollars plus less silver equals higher silver prices.

These are strong, multi-year trends. And none of them have changed in the last few days.

They explain why silver has gone higher, especially the move from $25 an ounce to $50 an ounce over the last year.

What they do not explain, however, is the move from $50 to $120 in the last couple of months.

This Time Is NOT Different

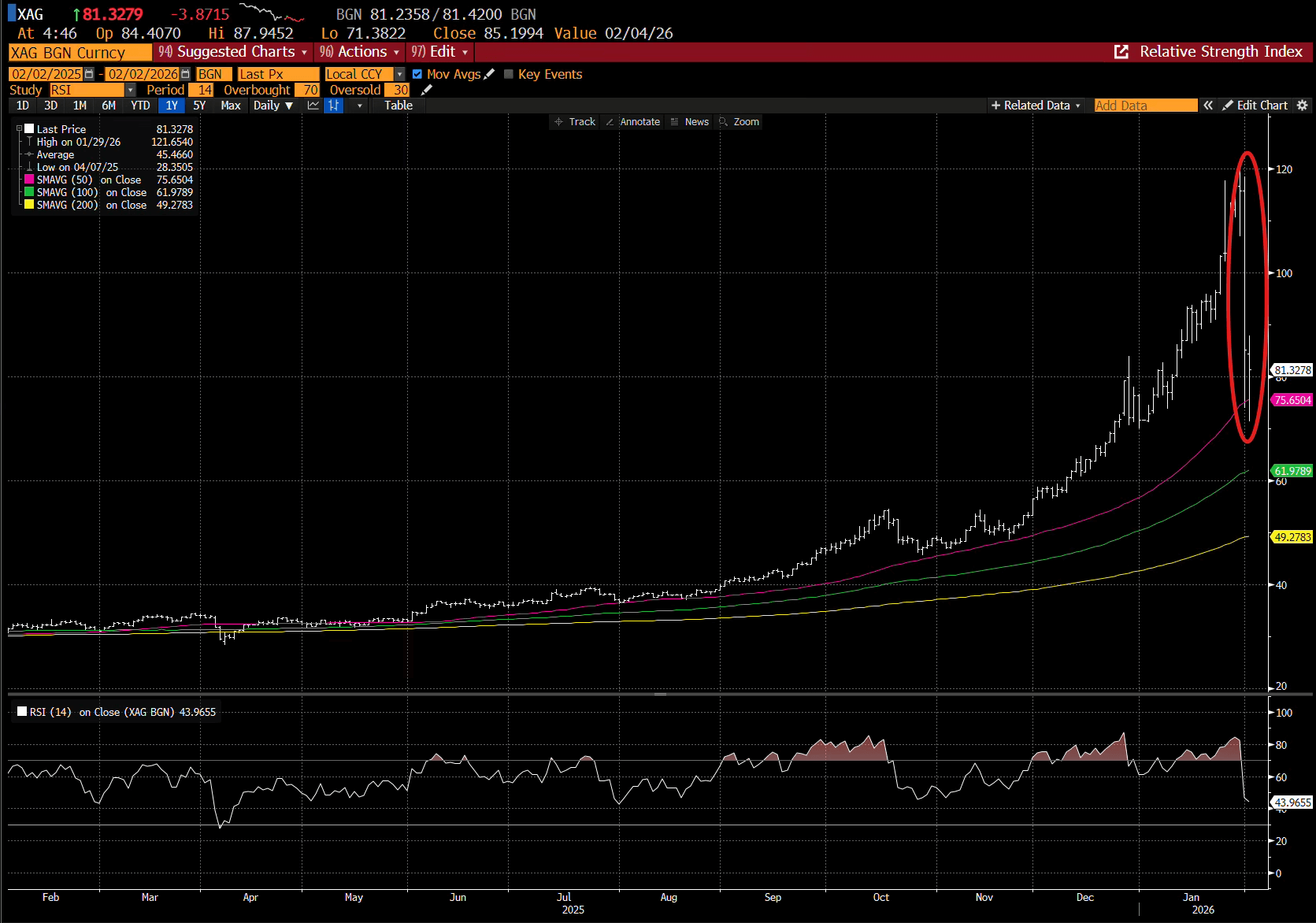

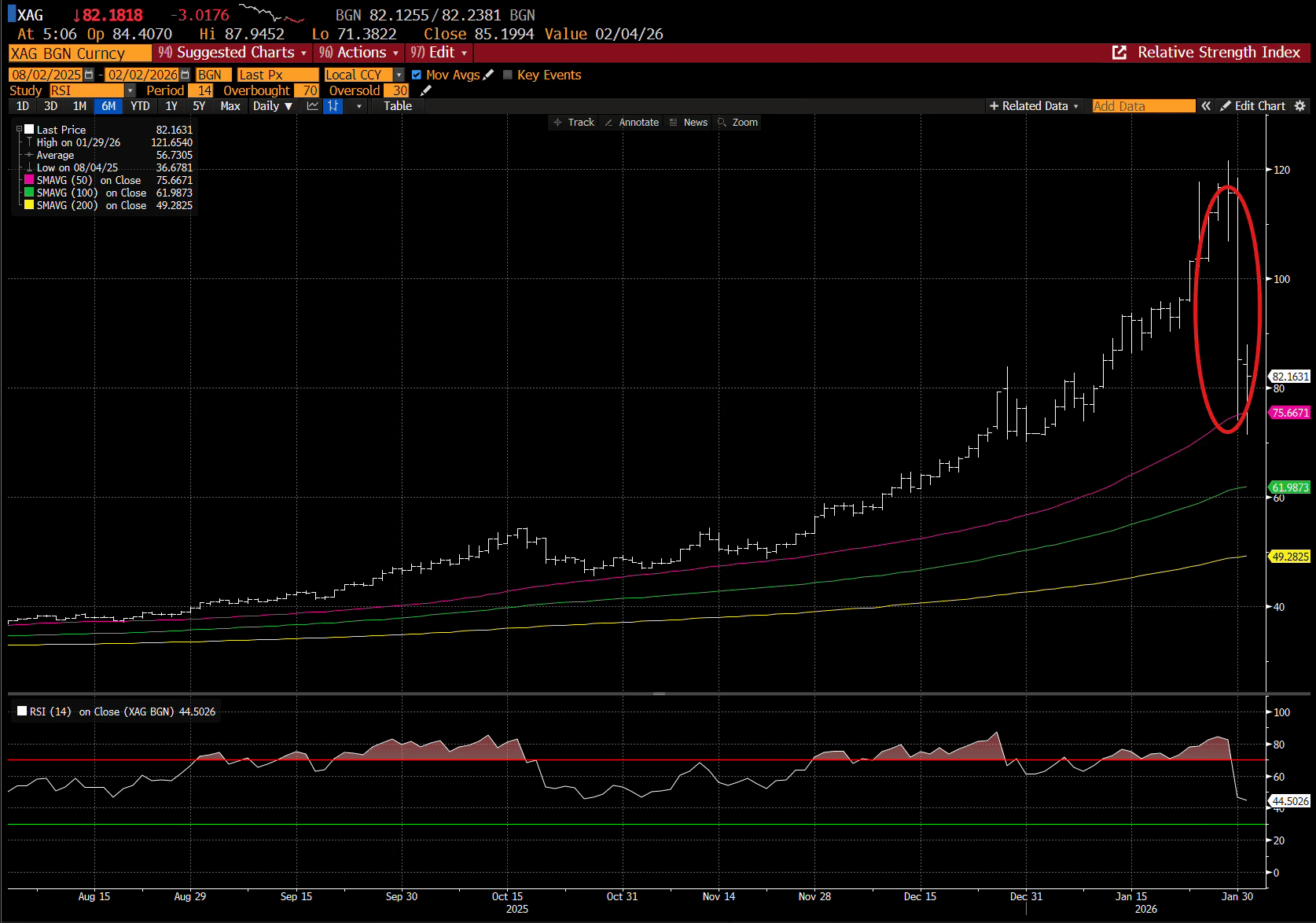

Take a look at this shorter-term chart of silver futures along with my favorite tactical technical analysis indicator, the relative strength index (RSI).

The RSI measures investor enthusiasm. A high RSI (over 70) is considered excessive, and prices usually struggle to climb higher in the short term after hitting this level.

Meanwhile, another “overbought” signal was also flashing red last week.

Silver was 60% above its 50-day moving average and 140% above its 200-day moving average — the largest amounts ever recorded.

This doesn’t have to do with the fundamentals, but rather the short-term dynamics of liquidity.

As silver prices gained momentum, it attracted investors who decided to participate because it was going higher.

They weren’t interested in the fundamentals of the metal itself. They were only interested in the price momentum.

This large group of investors had previously driven similar rallies in meme stocks and cryptocurrencies.

More recently, they have powered big moves in stocks tied to quantum computing and nuclear small-modular reactors.

Again, these investors don’t care about the long-term reasons to be bullish on silver. They only care that the price is going up.

And when the price stops going up? They sell.

Plenty of people insisted that this time was different. The demand for physical silver from Asian markets, for example, has created a new dynamic.

And while that might be true in the long-term, the physics of trading ALWAYS assert themselves in the short term.

That’s exactly what happened on Friday.

What You Should Do Now

If you’re a long-term holder, I would do nothing right now. The long-term bull case for silver remains strong.

It’s impossible to know where prices are headed from here, but I wouldn’t be surprised to see silver go higher — much higher.

Remember, there WILL be a supply response.

Folks are already melting down their old silverware to cash in on the price increase. Industries will also find substitutes or use it more sparingly with more supply.

And silver in the ground that is uneconomic at $20 per ounce might be a lot more attractive at $100 per ounce.

So with this pullback, should you add to your silver holdings?

The problem is that when an asset like silver crashes after a major overbought rally, the ride in the near-term is bumpy.

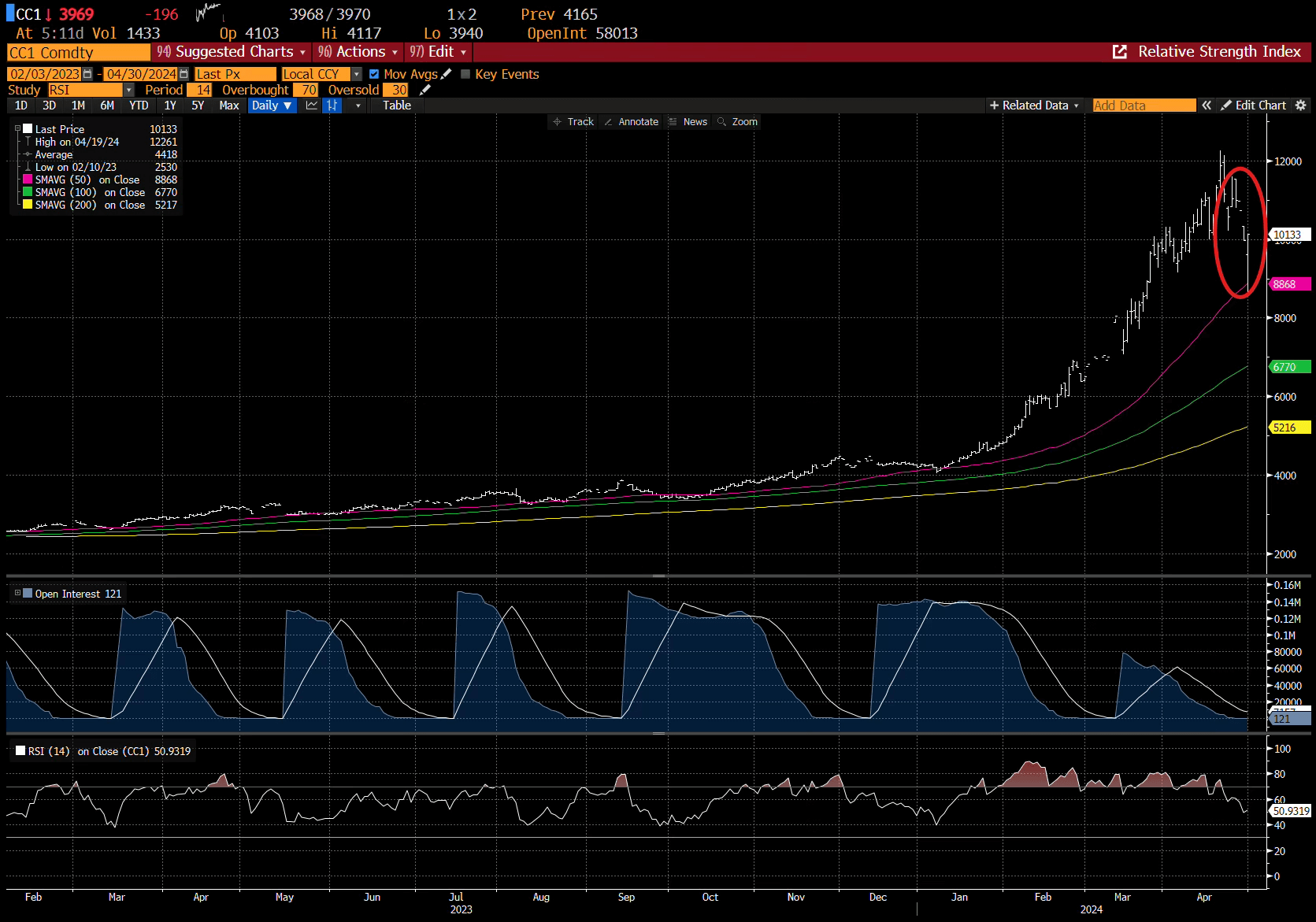

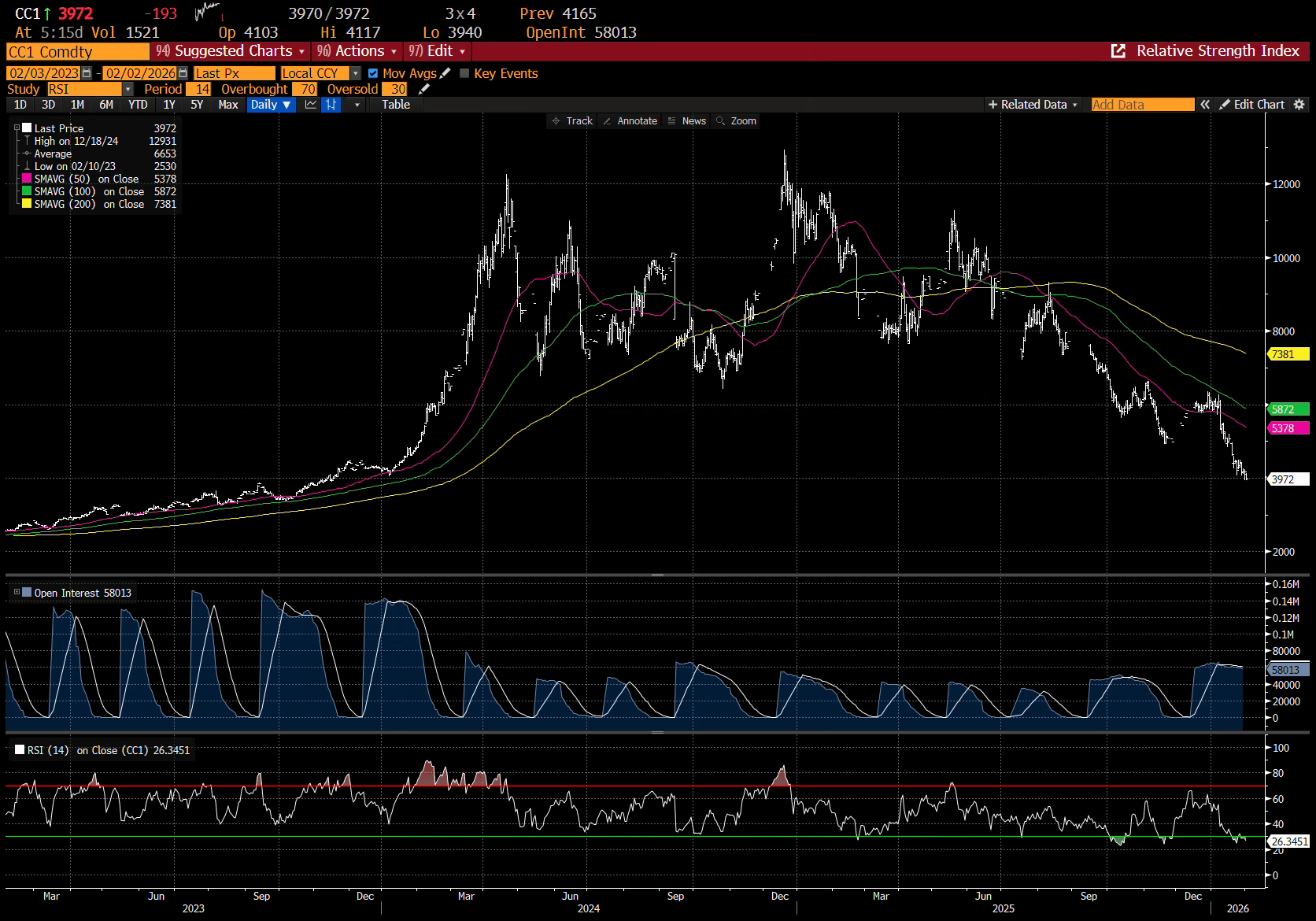

Take a look at this chart of cocoa futures from a couple of years back.

Look familiar?

Prices soared after a combination of bad weather and years of underinvestment resulted in a collapse in the cocoa crop in the Ivory Coast and Ghana.

At the time, bulls were saying it was a structural problem and would take years to solve. They said this time was different.

Here’s the chart through today.

After that initial break, cocoa prices collapsed to the 100-day moving average.

They then traded violently in a broad range from $6,000–$12,000. This persisted for about 15 months before they moved lower.

I don’t think we'll see the same move down in a couple of years in silver. But I do think silver may have seen its near-term high.

It could be months or even a year before it trades sustainably higher.

Whether you’re a long-term investor or watching from the sidelines, the best thing you can do right now is nothing — except buckle up for a bumpy ride.

Hi-Yo, Silver!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Lightning Round: Trump’s Fed Pick, the Silver Crash, and More

Posted January 30, 2026

By Greg Guenthner

Forget the Noise, You're Not Bullish Enough

Posted January 29, 2026

By Enrique Abeyta

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner

Greenland, Carry Trades, and Lazy CNBC Takes

Posted January 22, 2026

By Enrique Abeyta

“TACO” Out… “Big MAC” In

Posted January 19, 2026

By Enrique Abeyta