Posted October 09, 2025

By Enrique Abeyta

How to Handle a Bubble — You Have Four Options

You don’t have to be a market expert to spot a bubble. The hard part is knowing what to do about it.

In every financial bubble, plenty of investors see the warning signs but still get caught off guard when it inevitably bursts.

Others step aside too early, watch stocks soar, and miss out on one of the greatest wealth-creating runs of their lifetime.

I recently read something from one of my favorite financial writers, Ben Carlson, author of “A Wealth of Common Sense.”

He covered the topic of how to handle a bubble, including this quote from Jeremy Grantham about the current cycle:

“The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.

These great bubbles are where fortunes are made and lost – and where investors truly prove their mettle. For positioning a portfolio to avoid the worst pain of a major bubble breaking is likely the most difficult part. Every career incentive in the industry and every fault of individual human psychology will work toward sucking investors in.

But this bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios. Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives. Speaking as an old student and historian of markets, it is intellectually exciting and terrifying at the same time. It is a privilege to ride through a market like this one more time.”

Sounds smart, right?

The issue is that he wrote it in January 2021. Since then, the S&P 500 is up 90% and the Nasdaq has doubled!

This is the challenge with a bubble.

It presents both the opportunity to make some of the biggest returns you will ever see — along with the highest risk.

So how do you navigate a stock market bubble? There are essentially four options.

A: Do Nothing

This is the option that makes sense for most people. I often say that you should trade a lot or not trade at all.

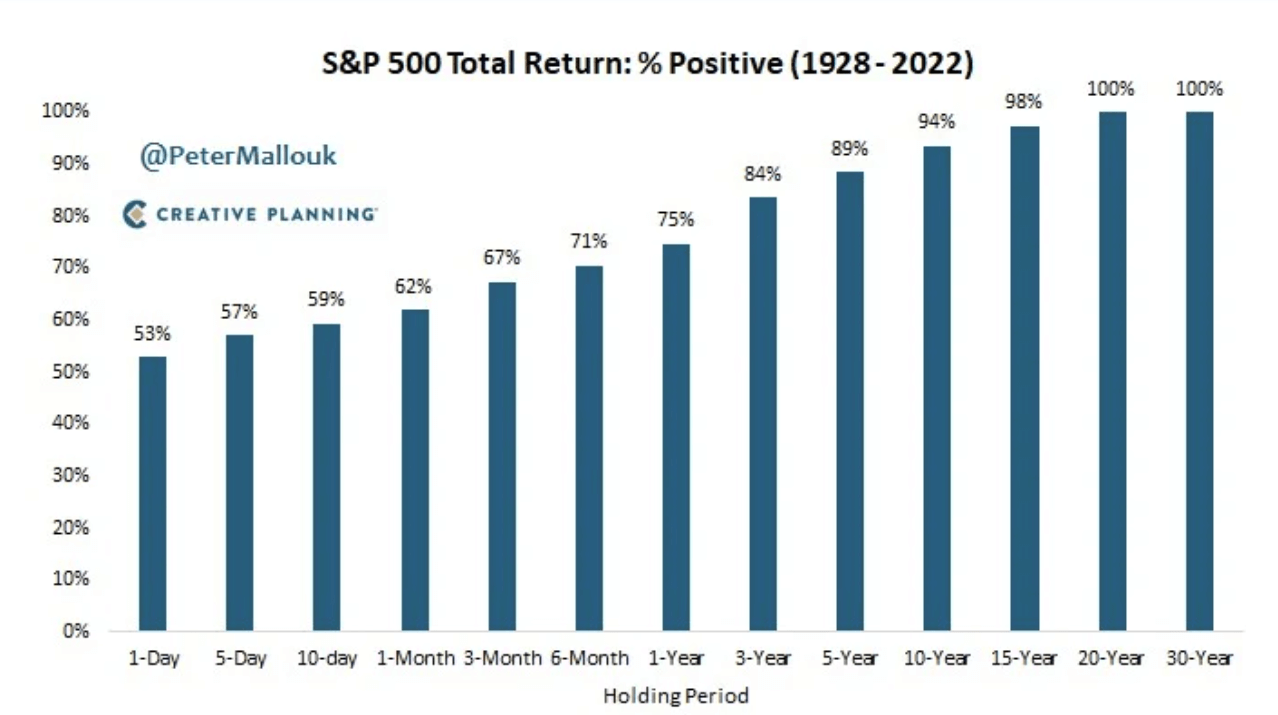

The fact is that in the long term, the stock market always goes up — and by a lot. Here’s a great chart illustrating this idea.

This table is from 2022, but the idea is even more true now. If you held your stocks for 20–30 years, you have NEVER seen negative returns.

The only challenge with this strategy is the ability to do so when faced with market volatility. This is why I recommend two things for a long-term strategy.

First, dollar-cost averaging. Put in money every single month without fail.

Second, don’t look. Simply do NOT look at that account.

Over time, this will pay off for you in a big way.

B: Go All In

George Soros once said, “When I see a bubble forming, I rush to buy, adding fuel to the fire.” I think about this quote a lot lately.

It speaks to the fact that financial bubbles present some of the best money-making opportunities of our lives.

A savvy trader can make a decade's worth of returns in a year, months, or even weeks in a bubble.

Soros took advantage of multiple bubbles and posted some of the biggest short-term gains of all time as a result.

The problem for most investors is that they are not quite as sophisticated as Soros.

It makes sense. Most of us don’t spend all of our time watching our investments and aren’t able to spend hundreds of millions on research and staff.

Going all in on the bubble for most investors presents a possibility of huge returns, but also the probability of disaster.

C: Hedge

Hedging means buying positions that balance the performance of your portfolio or present insurance in case of a big selloff.

This could involve holding cash or buying bonds to act as ballast in your portfolio. It could also involve buying something like put options.

These strategies can make a lot of sense, but they also require a lot of sophistication.

After all, it was flawed portfolio insurance strategies that led to the stock market crash in 1987.

Strategies today are much more sophisticated, but to hedge well is still difficult for many investors.

Just like going all in, it can take a lot of time and energy, two things that most folks don’t have to spare.

Now that leaves the final option, which is my preferred strategy.

D: Trade A LOT

You might wince just reading that. It goes against the guidance every financial advisor gives you (the same ones who make money investing your money for you).

My view is that anyone can take advantage of the bubble if they are active and disciplined.

That’s our mission here at Paradigm Press: sharing strategies backed by decades of experience with our readers.

You don’t have to be sophisticated like Soros or have decades of experience. That’s why we’re here.

Now that we’ve covered the four ways you can handle a bubble, I want to hear from you.

How are you feeling in this market cycle? Which approach have you been taking — and do you plan to change it now?

Drop me a line and let me know. I look forward to hearing from you!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Leverage Trap: A Painful Lesson in Risk

Posted October 17, 2025

By Greg Guenthner

4 Hard Truths for a Parabolic Market

Posted October 16, 2025

By Enrique Abeyta

Death By Greed: Silver Edition

Posted October 14, 2025

By Ian Culley

5 Charts Prove This Bull Has Legs

Posted October 06, 2025

By Enrique Abeyta

The “Forgotten Stepchild” Precious Metal Is Waking Up

Posted October 05, 2025

By Ian Culley