Posted January 29, 2026

By Enrique Abeyta

Forget the Noise, You're Not Bullish Enough

I’m an omnivorous reader.

Each morning, I spend hours going through financial news and market commentary, with viewpoints ranging from optimistic to downright gloomy.

I see a lot of the same questions raised over and over again in my morning reading. I’m sure you’ve seen them too.

Are we in a bubble?

Is technology still leading the market higher, or is it starting to drag the market down?

Is market breadth really expanding, or does it only appear that way?

And most importantly, will this be another positive year, or will markets finish 2026 in the red?

These are all good questions. But the problem is that the answers are just opinions, and usually not very compelling ones.

So it’s worth stepping back to see what the market has to say about it all. Let’s take each of these questions one at a time.

“Are We in a Bubble?”

The idea that we’re living through a market bubble has become one of the most persistent themes in recent commentary.

It shows up in headlines warning of excess, overheated valuations, and comparisons to past manias.

Source: Bloomberg Businessweek

But history suggests that bubbles don’t form simply because prices have gone up.

They form when participation becomes indiscriminate, speculation turns euphoric, and fear of loss disappears.

That’s not what today’s market looks like.

Over the past several years, investors have experienced repeated corrections, sharp rotations, and long stretches of frustration.

Entire sectors have fallen out of favor, only to recover later. Even now, skepticism is everywhere.

Many investors remain underexposed, cautious, or outright convinced that a major downturn is just around the corner.

Those are not the emotional conditions that typically mark the final stages of a bubble.

In fact, bubble narratives often grow loudest in the middle of durable trends. Fear doesn’t vanish overnight. It lingers, even as prices grind higher.

That lingering skepticism is often what allows trends to persist longer than most expect.

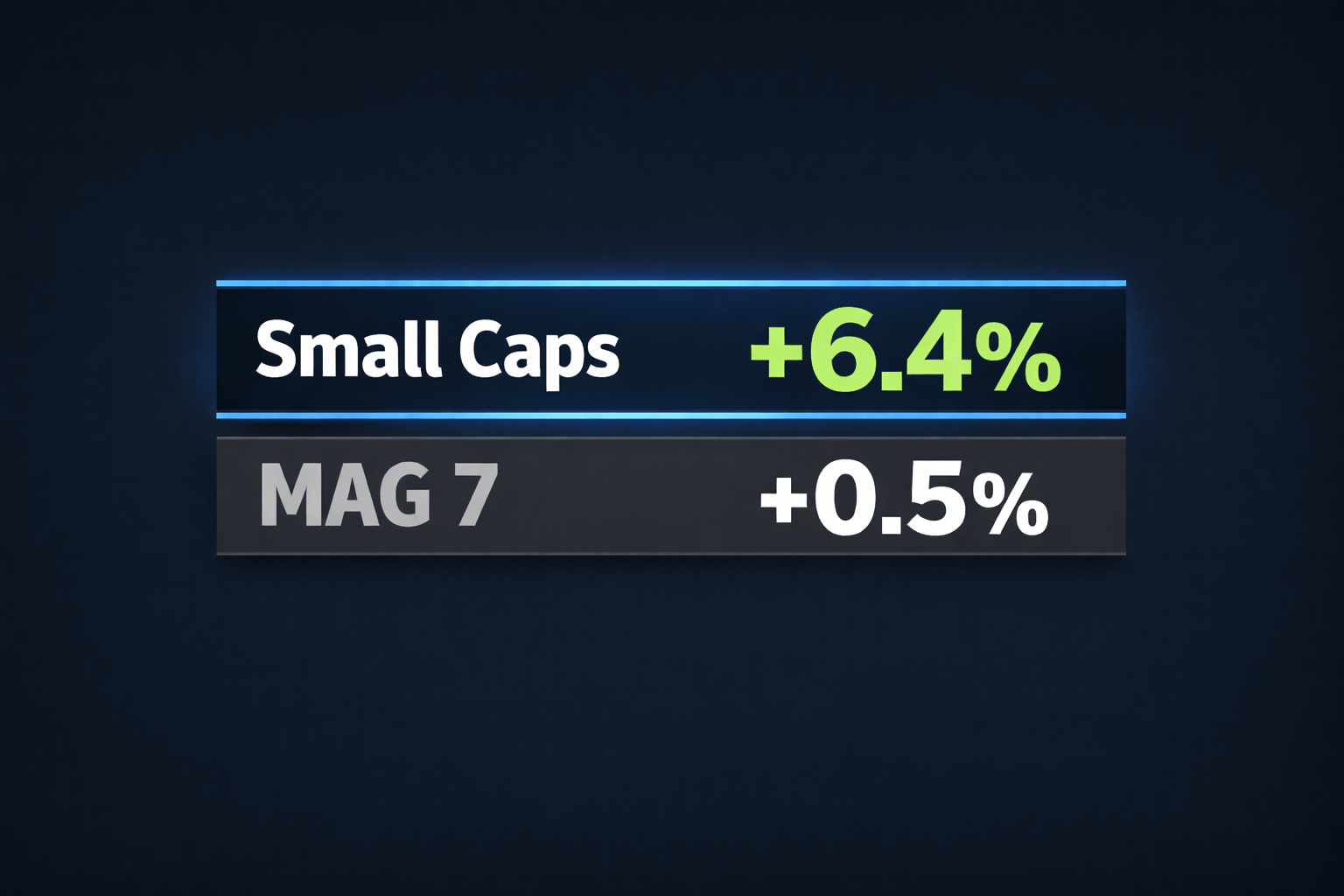

“Is Technology Leading or Lagging the Market?”

Another popular narrative making the rounds is that technology has stopped working.

After years of leadership, some of the largest tech stocks have spent time moving sideways rather than pushing sharply higher.

That has led many to conclude that tech is now dragging the broader market down. But it depends heavily on where you’re looking.

When attention is focused on a small group of mega-cap names, it’s easy to miss the bigger picture.

Broader technology groups, including equal-weighted and diversified tech indices, continue to show strength.

That suggests leadership is rotating, not disappearing.

Markets don’t need the same stocks to lead forever. In healthy environments, former leaders pause or consolidate while new areas step forward.

This kind of internal rotation is a feature of resilient markets.

“Is Market Breadth an Illusion?”

Market breadth has become one of the most misunderstood topics in today’s market commentary, especially when it comes to the S&P 500.

Breadth is meant to describe how many stocks are participating in a move.

Still, it's often reduced to the performance of the traditional, cap-weighted S&P 500 versus its equal-weighted counterpart. This is an oversimplified comparison.

When the equal-weighted S&P 500 lags the cap-weighted index, many commentators frame it as a warning sign.

The argument usually sounds like this: if only a handful of large stocks are driving gains, the market must be unhealthy.

But this interpretation ignores how the S&P 500 and other indices are constructed.

By design, the cap-weighted indices give enormous influence to their largest constituents, particularly in technology. The equal-weighted versions intentionally remove that influence.

As a result, divergence between the two often reflects sector exposure rather than deteriorating participation.

For example, when large technology companies outperform, the cap-weighted S&P 500 naturally looks stronger.

When leadership rotates away from those names, the equal-weighted index may catch up.

Neither outcome automatically signals trouble. It simply shows where leadership is concentrated at a given moment.

This is also why claims that “only a few stocks matter” tend to miss the point.

Markets don’t require perfectly uniform participation to remain healthy. They require enough leadership to keep capital moving.

And that leadership can shift over time without breaking the broader trend.

So when breadth within the S&P 500 is examined more holistically, the picture looks far less fragile.

Many stocks outside the mega-cap leaders continue to trend higher, suggesting participation has shifted. And that’s ok.

That kind of uneven participation is typical during periods of rotation, not breakdown. And it aligns with a market that is adapting rather than weakening.

“What Does All This Mean for 2026?”

This brings us to the question everyone wants answered. Will 2026 be a good year for the market?

Here’s where calendar psychology tends to lead investors astray. It’s also where historical context can be helpful when used correctly.

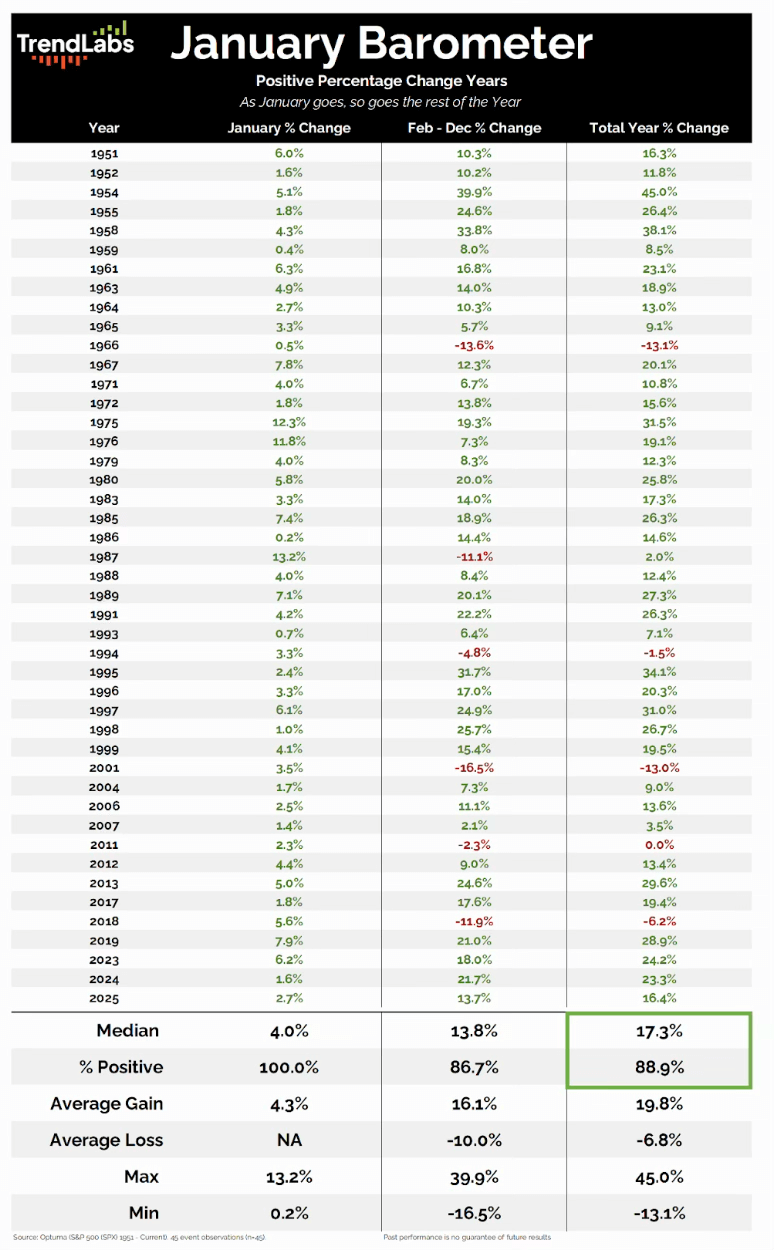

One of the most well-known seasonal indicators is the “January Barometer,” devised by Yale Hirsch in 1972.

The concept is simple. As January goes, so goes the year. It’s not a trading signal, but a way to frame expectations.

Historically, when the market finishes January higher, it has gone on to finish the full year higher nearly 89% of the time.

Source: TrendLabs

That statistic doesn’t guarantee smooth gains, nor does it eliminate the possibility of volatility along the way. But it does provide important context.

Markets that start the year on solid footing tend to maintain their upward bias more often than not.

The key point is that markets don’t reset because the calendar flips. They care about trend, liquidity, and behavior.

January doesn’t dictate destiny, but it often sets the tone.

And when that tone is constructive, history suggests investors should focus less on predicting disaster and more on respecting the prevailing trend.

So far, price behavior points toward continuity rather than collapse.

That doesn’t mean pullbacks won’t happen. But markets rarely unravel when fear remains widespread and narratives are this conflicted.

More often, those conditions support rotation, resilience, and selective opportunity rather than broad failure.

The Bottom Line

When you step back from the noise, a consistent theme emerges.

Many of the loudest concerns circulating today are rooted in interpretation rather than evidence.

Bubble fears, anxiety about tech leadership, and confusion over breadth all stem from focusing on narrow signals in isolation.

Markets don't move based on what sounds convincing in a headline. They move in response to capital flows, participation, and trend structure.

Those signals are often quieter and less intuitive, but they matter far more than the stories dominating daily news cycles.

In the end, no matter what the news is saying, my view is straightforward.

I remain bullish on the market in 2026.

Not because I believe it will be easy or free of volatility, but because the underlying evidence continues to support persistence rather than breakdown.

As always, the edge doesn’t come from predicting the future. It comes from seeing the present clearly and acting accordingly.

And when history, price action, and investor psychology all point in the same direction as they do currently, it’s a reason to remain bullish.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner

Greenland, Carry Trades, and Lazy CNBC Takes

Posted January 22, 2026

By Enrique Abeyta

“TACO” Out… “Big MAC” In

Posted January 19, 2026

By Enrique Abeyta

What to Do While Silver Goes Vertical

Posted January 16, 2026

By Greg Guenthner

Insider Trading From Hamilton to Pelosi

Posted January 15, 2026

By Enrique Abeyta