![[Breakout Confirmed] This 10x Trade Is Taking Off](http://images.ctfassets.net/vha3zb1lo47k/5SZCYl7OZbRTZpXv6ItiqQ/fcc3fb7ac31039e02a1e4ef1ff161ca5/ttr-issue-07-01-25-img-post-2.jpg)

Posted July 01, 2025

By Ian Culley

[Breakout Confirmed] This 10x Trade Is Taking Off

I know I’ve been a broken record about Sibanye Stillwater (SBSW).

Every few weeks, I’m hounding you about this South African mining company while everyone else is chasing the latest AI darling or quantum computing breakthrough.

But here’s why I haven’t shut up about SBSW since April – and why I’m not about to start now…

The stock has been quietly climbing since I first made the case. Not in some dramatic, headline-grabbing way. Just steadily, methodically proving the thesis right.

And here’s the beautiful part: everything that made it compelling six months ago is still true today.

Actually, it’s gotten better.

You might be thinking, “Okay, but if it’s been going up, haven’t I missed my shot?”

Not even close.

The fundamentals I originally spotted – the tightening supply, the critical minerals demand, the institutional money starting to wake up – they’re all still playing out.

The 10-bagger potential we talked about? Still very much on the table.

What’s changed is that SBSW has now proven it can move when the stars align. And we’re still in the early innings of this story.

Let me bring you up to speed on why this “boring” mining play is still one of the most exciting opportunities I see for the next few years. And why you need to pay careful attention now… before the train leaves the station for good.

A Roaring Commodity Bull

A weakening dollar and platinum and palladium’s absence from the new highs list piqued my interest earlier this spring.

But this story begins with gold and the broader commodity bull run.

Historically, gold has been the catalyst for commodity supercycles. Gold bugs have a knack for sniffing out rising inflation.

So far, the shiny yellow metal has doubled since its 2022 low. Meanwhile, silver has notched a new 14-year high, and Copper has rallied back above five bucks. Even the Global X Uranium ETF (URA) just recorded its highest level in twelve years.

But metals aren’t the only commodities experiencing historic rallies.

Cocoa and coffee prices revisited their 1970s peaks, just before they ripped to new all-time highs. Plus, live and feeder cattle finished June with their highest monthly closes on record.

These are hallmarks of a roaring commodity bull, and I’ve yet to see any sign this run is over.

Consider this: past commodity rallies have lasted at least a decade. We’re only in year five. It was only a matter of time before platinum and other precious and industrial metals joined the rally.

Last Spring, Adam Sharp also noted platinum’s underperformance in The Daily Reckoning and highlighted political instability and limited supply as potential catalysts for a resurgence in prices.

Since his writing, buyers have absorbed supply like never before. Meanwhile…

The New York Times reported this morning that the U.S. Dollar Index (DXY) posted its worst first-half performance since 1973. (You know the dollar is making waves when the Times is writing about it.)

Kickstarting The Rally

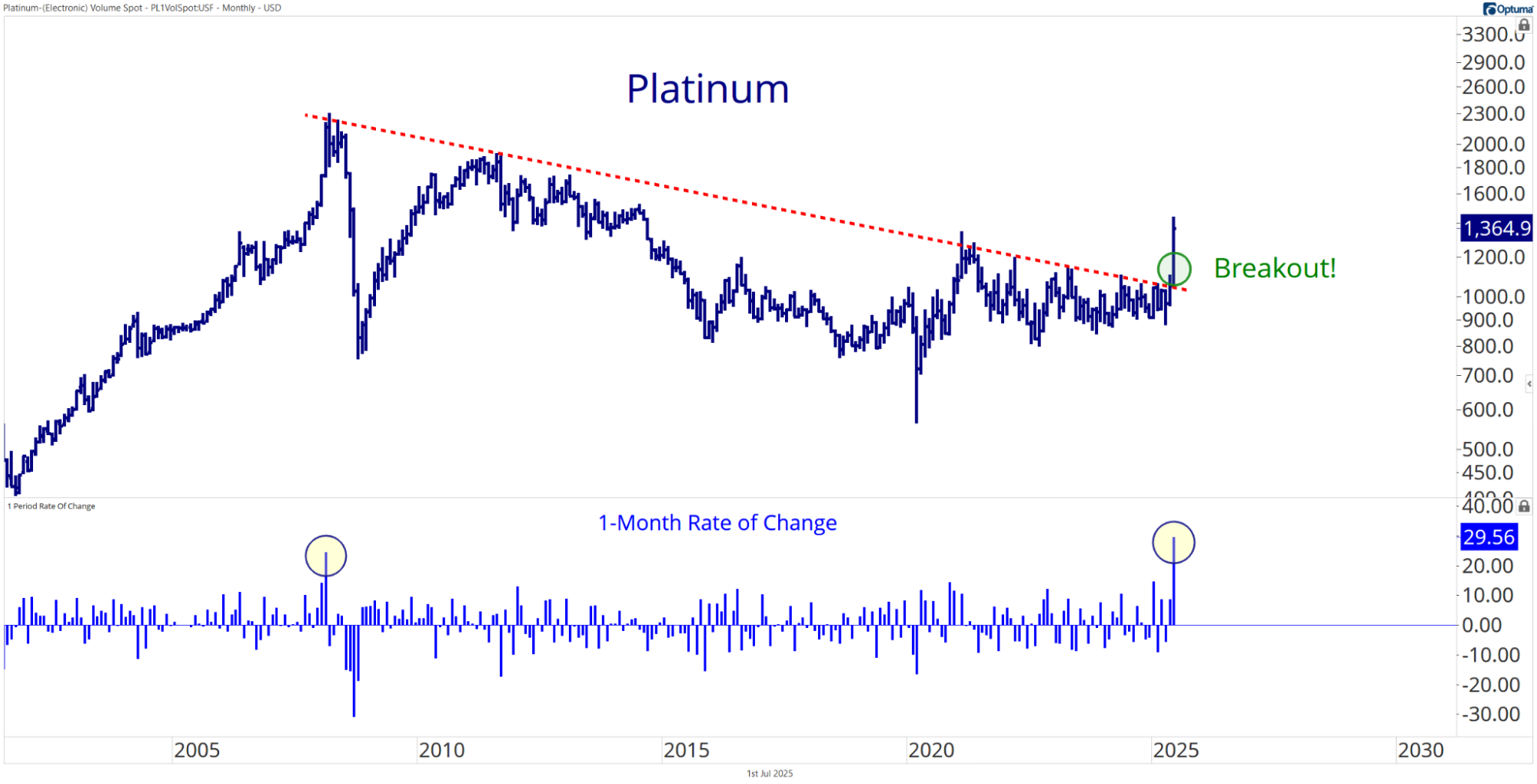

Last month, platinum rallied approximately 29%, its strongest one-month performance in history (lower pane, highlighted in blue)...

Unsurprisingly, PGM mining stocks also rocketed to new highs.

Aside from the breakout, last month’s momentum thrust is easily the main takeaway from the platinum chart.

Explosive expansions in momentum often mark the beginning or the end of a trend. Notice that the last time the 1-month rate-of-change came anywhere near this June’s reading, it coincided with the 2008 blow-off top (yellow circles).

Following the ‘08 peak, platinum has traded within a 17-year downtrend... Until last month.

Now’s Your Chance to Get Involved

I wrote in late April:

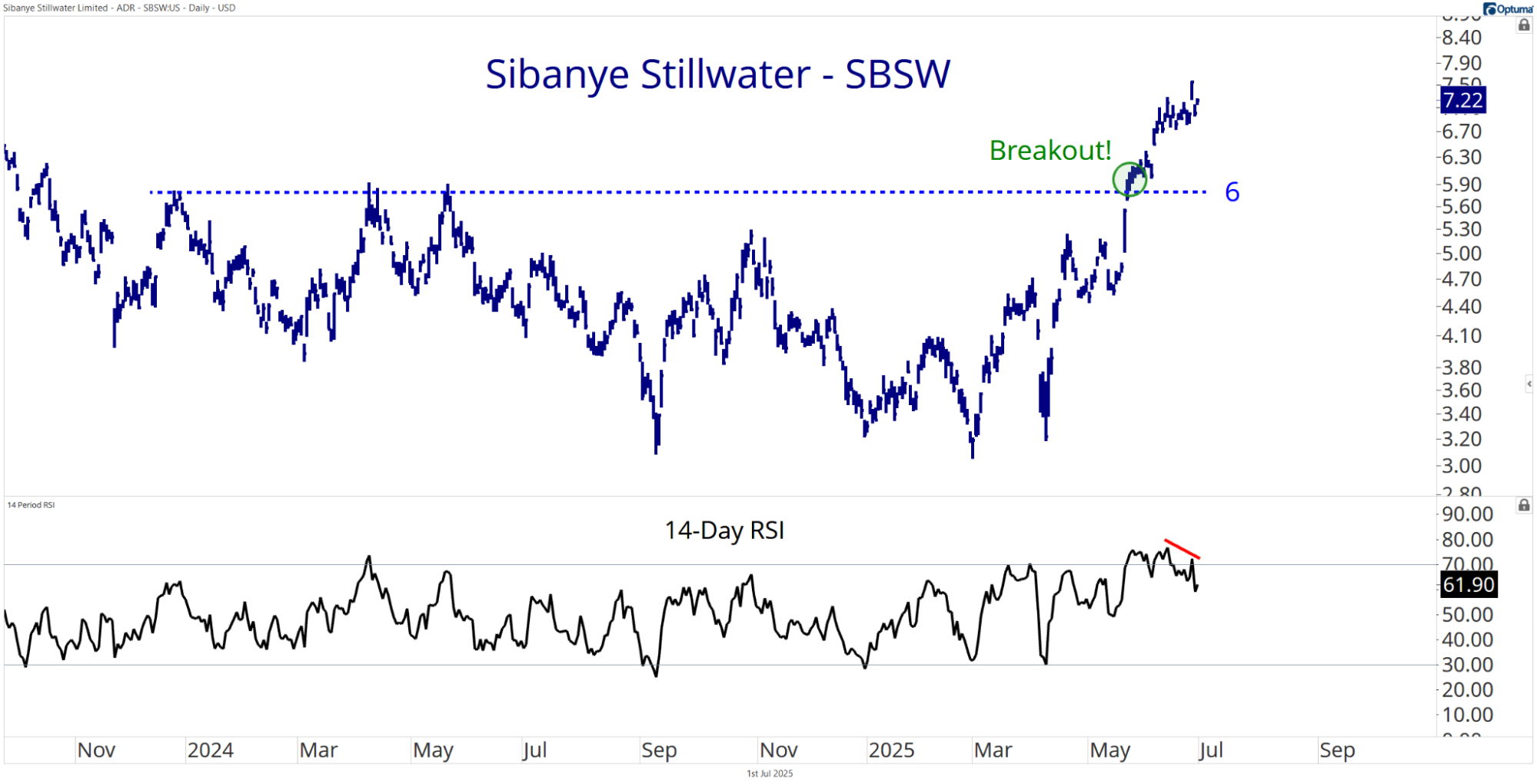

“It all comes down to minimizing regret. I’d rather begin nibbling on SBSW while it continues to churn below six bucks, then lift my head twelve months from now with nothing to show as it’s trading at eight or ten dollars with increasing upside potential.”

Three weeks later…

SBSW broke above $6. That happened much faster than I expected!

Sibanye shares have gained roughly 60% over the past two months50. Entering a new position at this point is like trying to catch a train speeding down the tracks. It’s possible, but highly dangerous to you and your portfolio.

However, don’t worry if you missed the initial thrust above $6.

You can see that the momentum is beginning to wane in the lower pane (highlighted in red). This could mark the beginning of a correction that will lead SBSW to retest its $6 level. The same level that kept prices at bay in 2024.

Buyers who missed the breakout in May will likely snap up shares on a dip back to these levels.

I like adding to existing longs on a dip, but I’ll also give SBSW a little room to dance.

Keep in mind that mining stocks experience wild price swings, similar to commodities.

SBSW up 50% in just a few months says it all.

Any throwback above $5.25 doesn’t concern me. In the event prices are dribbling below five bucks, I’ll review the overall market conditions and reevaluate SBSW’s bull case.

This party is just getting started.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Elon Musk Changed My Life Forever

Posted June 30, 2025

By Enrique Abeyta

How I Build MONSTER Positions

Posted June 27, 2025

By Greg Guenthner

Ken Griffin Is Full of Sh*t

Posted June 26, 2025

By Enrique Abeyta

The “Wall of Worry” Climb Is Over

Posted June 24, 2025

By Ian Culley

GME: A Warren Buffett Kind of Stock

Posted June 23, 2025

By Enrique Abeyta