Posted October 16, 2025

By Enrique Abeyta

4 Hard Truths for a Parabolic Market

The market has felt unstoppable lately.

Every dip gets bought, and stocks keep grinding to new high after new high.

If you’ve been along for the ride — and I hope you have — then your portfolio has probably been crushing it these past few months.

That’s the good news. Now for the bad news…

A market this good never lasts. In fact, it could come to an end at any moment.

When prices rise this much this fast, it’s hard to maintain discipline.

So today, I want to lay out a few thoughts about this parabolic market and what you should be doing right now.

This Is Normal (But Not Sustainable)

When you see triple-digit returns in a short amount of time, the smart money will say that it “isn’t normal.” Well, they are wrong.

It is normal for this stage of a bull market. As a bull market matures, it always hits a stage where you see outrageous returns.

The kind of returns that you might expect to see over several years may occur in just a few months or even weeks.

At this stage, triple-digit winners become the expectation, not the exception.

It happens every time in the late stages of a bull market, which means that it’s completely normal.

What it’s not, however, is sustainable.

At some point, it will inevitably end. Your best strategy is to stay disciplined and take profits on triple-digit winners before it’s over.

Because you know what doesn’t go down after a stock market top? Cash.

It’s Like a Party at 3 a.m.

It’s hard to take profits right now, right? Every sale looks bad when the stock doubles right after you sell it.

The analogy I have been sharing with folks is that this is like a big party at 3 a.m. Everyone has been drinking all night and having a great time.

This is about the time when the 20-somethings are hugging and slapping each other on the back, talking about how they’re going to live forever.

They won’t. Sure, they may live a long time. But the reality is that they are still going to wake up tomorrow with (at minimum) a headache.

Worst case? They try to drive home and end up wrapping their car around a tree.

I’m here to be your designated driver and tell you to take some profits.

This Time Is NOT Different

In the short term, I am worried about precious metals, especially silver. In fact, I am the most concerned I have been in my entire three-decade career.

This isn’t just an opinion; it’s based on data.

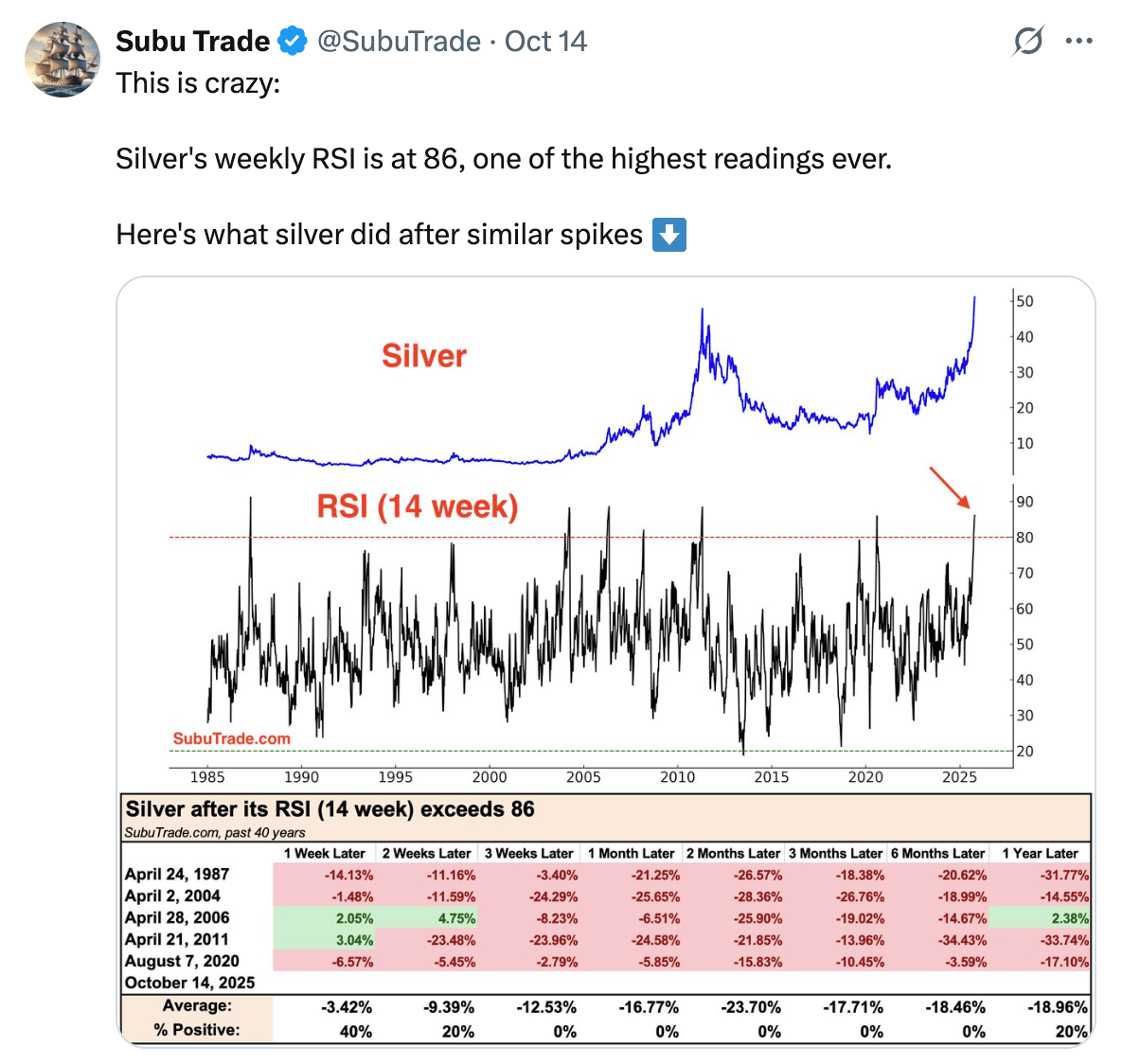

Here is something we recently shared on X from one of my favorite research services, Subu Trade.

They point out that silver is the most overbought (as measured by weekly RSI) as it has been in the last 40 years.

Every time it has been at these levels, it has been lower three weeks, one month, two months, three months, and six months later, by an average of more than -15%.

Read that again… EVERY TIME.

I can hear the chorus out there that “this time it is different.”

It isn’t. Take some profits.

Buy Insurance Before You Need It

Earlier this week, I had a conversation about precious metals with some of my colleagues at Paradigm Press. I got heavy pushback for saying that now is a time for profit-taking.

Other analysts argued that gold is going to $5k, $10k, or even $15k. Silver could be going to $100, $200, or even $500.

I don’t disagree. But it still makes sense to take some profits right now. Here’s a personal story that will help illustrate my point.

I’m currently staying at a friend’s home in Carefree, Arizona. From the patio of my casita, I can see my old house at a nearby spot called Black Mountain.

I bought that house years ago because I loved it and thought it was a great investment.

Given the location, the property, the house itself, and the giant Taiwan Semiconductor plant nearby, I thought it could appreciate 2x, 5x, or even 10x in the coming years…

Just like precious metals right now.

But when I bought the house, I didn’t buy flood insurance.

If you’ve ever tried to buy flood insurance in an area that doesn’t flood often, you’ll know it’s very hard to get. There are no underwriters, and it’s expensive.

Floods aren’t common in Arizona, but they do happen, especially around the late summer storms (called monsoons around here).

Well, a few years after I bought the house, a monsoon came through our area, and the wind blew open our (unfortunately unlocked) front doors.

As a result, we had 10,000 gallons of muddy water run through the house and destroy our entire bottom floor.

It was $1 million worth of damage. Again, we did not have flood insurance.

Well, we made the repairs and eventually sold the house a few years later for about 2.5x what we paid for it.

But it would have been 3.5x had we had flood insurance.

This is my point about precious metals right now. Like many of my colleagues, I think they will go much higher from where they are now.

The problem is that, given the one-sided enthusiasm, they could be hit with a market monsoon very soon.

Are you properly prepared?

The best insurance policy you can take out right now on your big gains is taking profits.

Remember: in the stock market, it is not what you make; it’s how much you keep.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Death By Greed: Silver Edition

Posted October 14, 2025

By Ian Culley

Everyone Loves the Rally…. Except the Data

Posted October 13, 2025

By Enrique Abeyta

How to Handle a Bubble — You Have Four Options

Posted October 09, 2025

By Enrique Abeyta

5 Charts Prove This Bull Has Legs

Posted October 06, 2025

By Enrique Abeyta

The “Forgotten Stepchild” Precious Metal Is Waking Up

Posted October 05, 2025

By Ian Culley