Posted January 05, 2026

By Enrique Abeyta

2026: The Leaders, the Laggards, and a Wild Card

It’s the first full trading week of 2026, and prediction season is in full swing.

To kick off the new year, I wanted to share some of my surprise predictions for the next 12 months.

Like stock picking, predictions are all about probability. There are no guarantees.

What I’m presenting here are some out-of-consensus views that I think aren’t just possible — they’re probable.

Outcomes that, if they happen, are going to surprise a lot of folks.

And I don’t want you to be caught off guard. So here we go…

The Mag 7 (Barely) Underperform

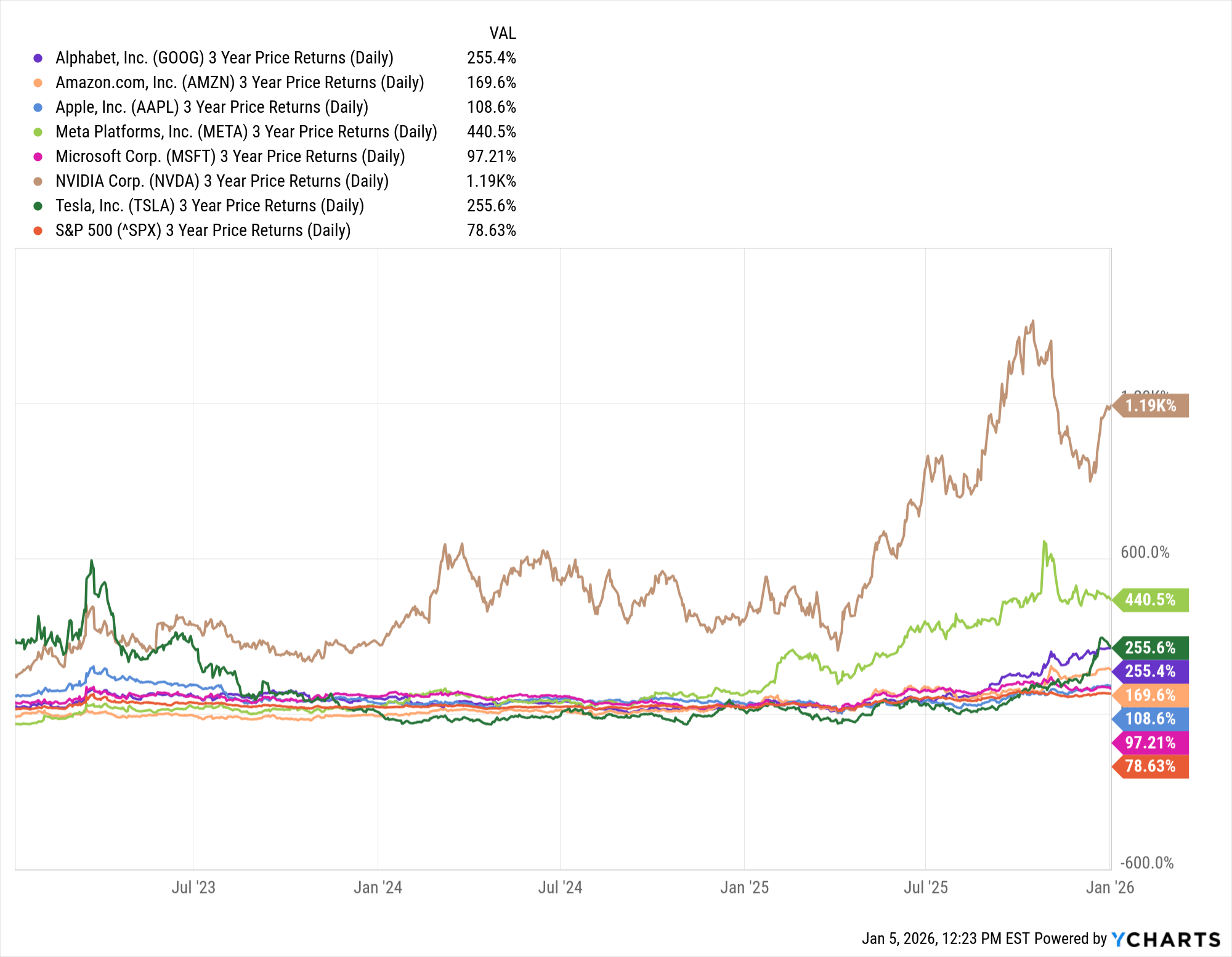

It’s been an incredible few years of outperformance for the Mag 7. Below is a chart showing how these leading stocks performed over the past three years.

After surging 75% in 2023 and rallying another 60% in 2024, the Mag 7 finished last year with another solid return of over 20%.

But 2025 was the year these stocks outperformed the least, with half of them underperforming the S&P 500’s 17% return.

I think 2026 will be the first year in a long time that these stocks underperform as a group. But I don’t think it bodes as badly for stocks overall as you may think.

The root of the underperformance is going to be Nvidia and issues around the growth and development of AI.

At some point in 2026, I think OpenAI will run into difficulties getting the financing for its trillion-dollar buildout. Ultimately, I think there’s no chance they get as much as they need.

When this happens, we will see a major scare in everything AI. But after this steep selloff, I still believe the AI rally continues.

How can this happen?

Well, AI is much bigger than OpenAI. The company may be relegated to “Netscape” status, but the other leading companies (including some of the Mag 7) will be big beneficiaries.

They will benefit as AI revenues ramp, their existing businesses continue to perform, and (most importantly) they slow down their capital expenditure, allowing their cash flow to explode higher.

The bad news? Nvidia is where all that money was going.

By the end of this year, I think the OpenAI crash and Nvidia’s decline will keep the Mag 7 from outperforming the market as a group.

But I still think several of the Mag 7 are going to be incredible opportunities.

Small Caps Finally Outperform

In the long term, I’m not a fan of small-cap stocks. They’re sub-scale companies with inferior balance sheets and more exposure to variables like inflation, interest rates, and commodities.

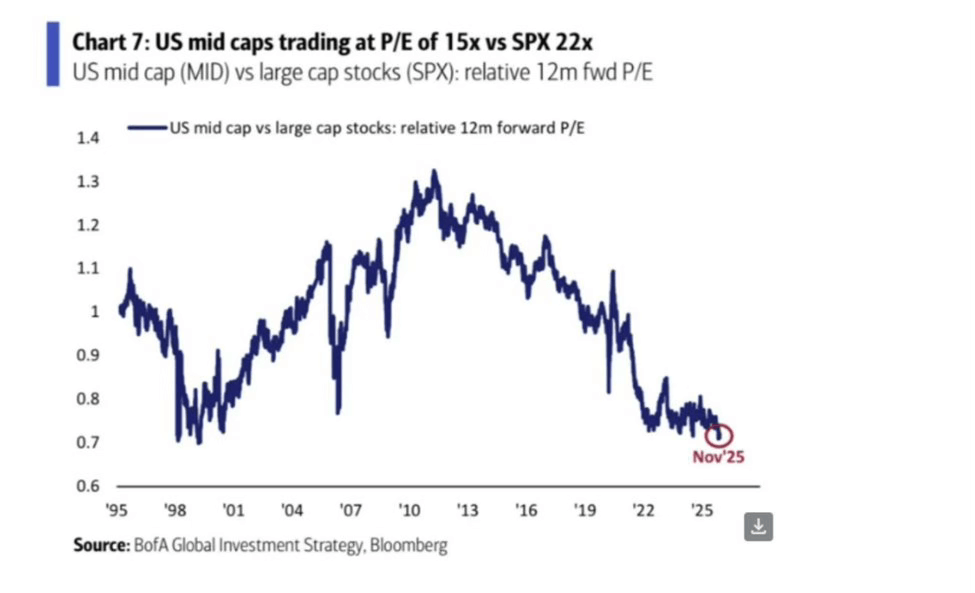

But right now, they have undemanding valuations. Look at this chart showing the valuation of the mid-cap stocks over the last few decades.

Valuations are back down to relative levels last seen in the late 1990s.

Back then, we saw a rotation into technology leaders (think today’s Mag 7), causing increased multiples in those stocks and lower multiples in everything else.

With an acceleration in non-AI economic growth and lower interest rates, I think the setup for smaller stocks is superb.

Remember that in 2000, the S&P 500 was down 9% and the Nasdaq was down 40%. But the Russell 2000 was only down 4%, while the equal-weight S&P 500 was up 12%.

We don’t think the major indices will be down as much as they were in 2000. But the outperformance of smaller stocks could be just as much.

Rates Matter Again (But Not Inflation)

For the last several years, I have maintained that neither interest rates nor inflation mattered much to the stock market.

The reason was simple: neither was doing very much. After some big moves post-COVID, both have been in relatively narrow ranges.

Remember the important thing with inflation and interest rates is if they are moving a lot quickly (they have not been) or if they are at high absolute levels (they are not.)

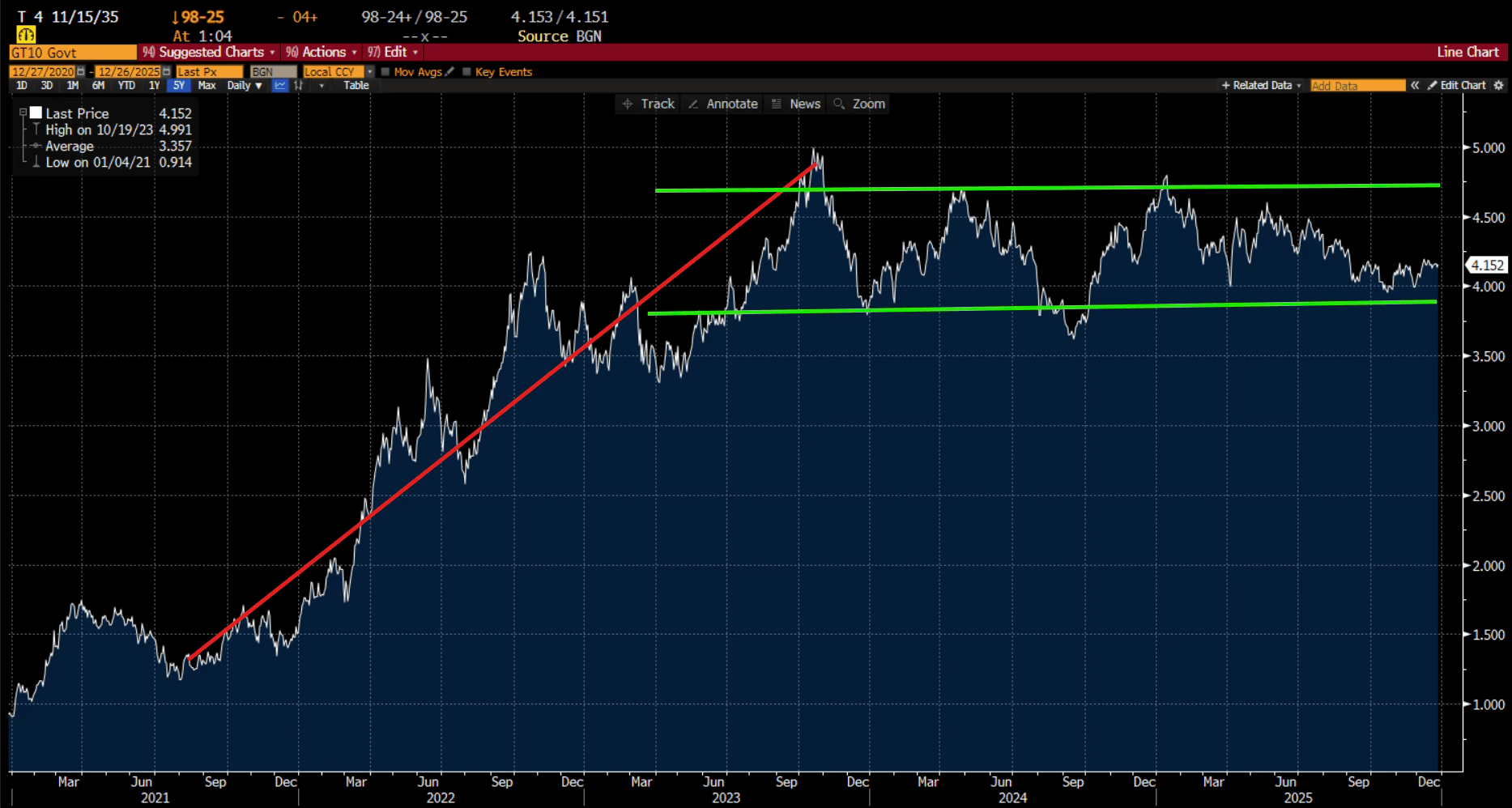

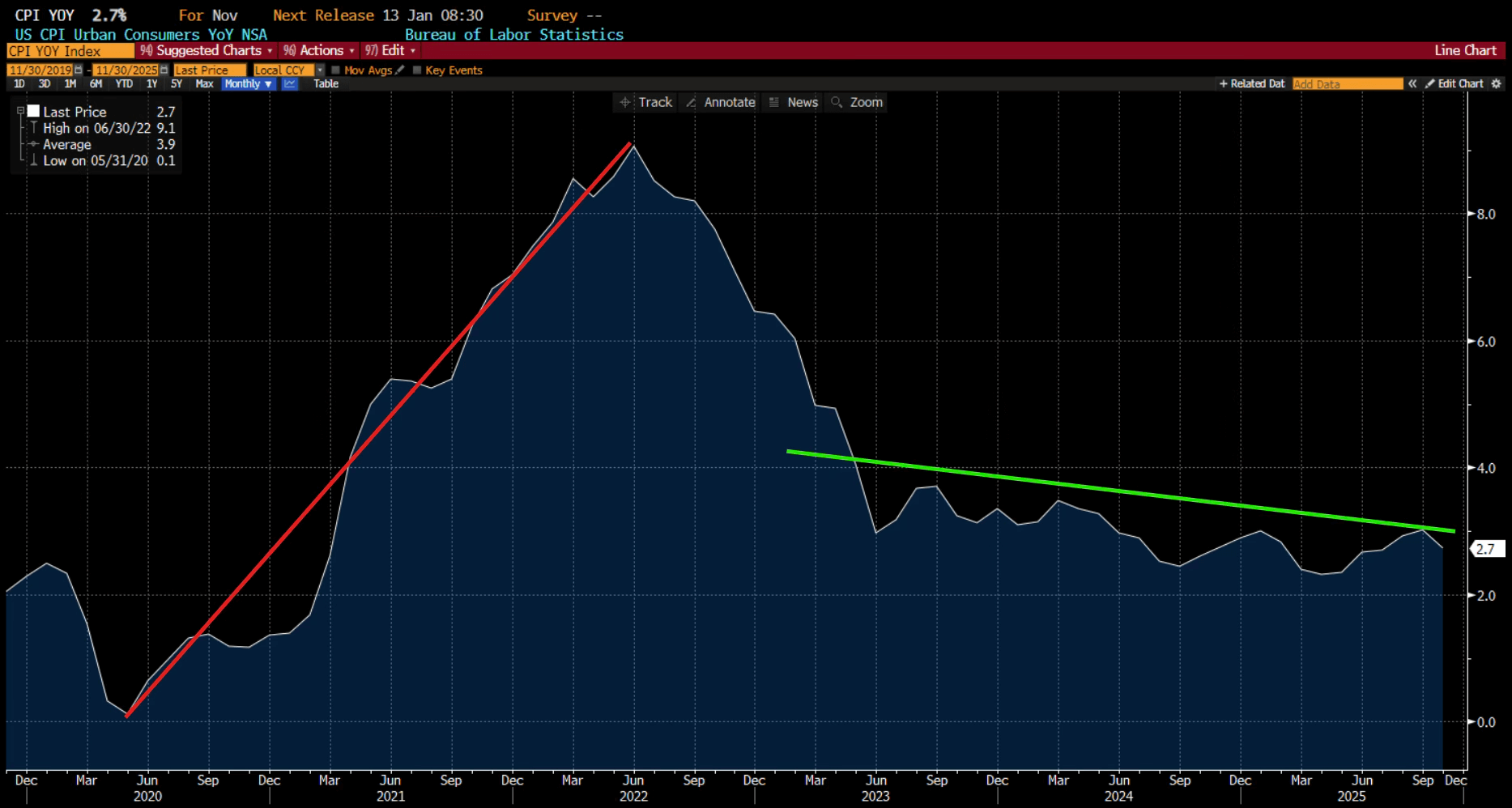

Here are the charts of the yield on the U.S. Government 10-year benchmark bond and the leading measure of inflation (the Consumer Price Index or “CPI”)…

Interest Rates: U.S. Government 10-Year Bond Yield

Inflation: Year-Over-Year Change in Consumer Price Index

Both rates and inflation have been going down for a while now. Perhaps not as much or as fast as some would like, but they are definitely going down.

This has been a tailwind for stock prices in the last couple of years, but not a major driver. I think that changes in 2026.

I think that the combination of weakening employment, a new Fed Chair, political pressure from Trump, and the OpenAI crash will lead to the Fed cutting rates — a lot.

How much? We could see -100bp to -150bps in the next 18 months. This will be substantial enough to have a major impact on stocks.

I think it will help stocks recover from the AI volatility and then could be the rocket fuel for a 1999/2000-type blow-off top.

Get ready for a wild ride! Speaking of which…

The Market Gets Volatile — But Ends 2026 Up

I think we will see volatility return to the stock market this year. But I also predict the market indices will be higher by year-end.

They could be substantially higher if the long-awaited melt-up materializes. That event could wait until 2027, though.

Either way, I think the combination of earnings growth, economic growth, and lower interest rates means stock prices move higher this year.

There has never been a prolonged stock market selloff without the Fed raising rates. Until they are ready to do that, stocks will continue to go higher.

The difference between this year and recent years may be volatility.

I think that 2026 could look like 2025, but with the “OpenAI-pocalypse” replacing the “Trump Tariff Tantrum” as the mid-year catalyst.

Given the market capitalization of leading AI stocks like Nvidia, this means the indices could move a LOT.

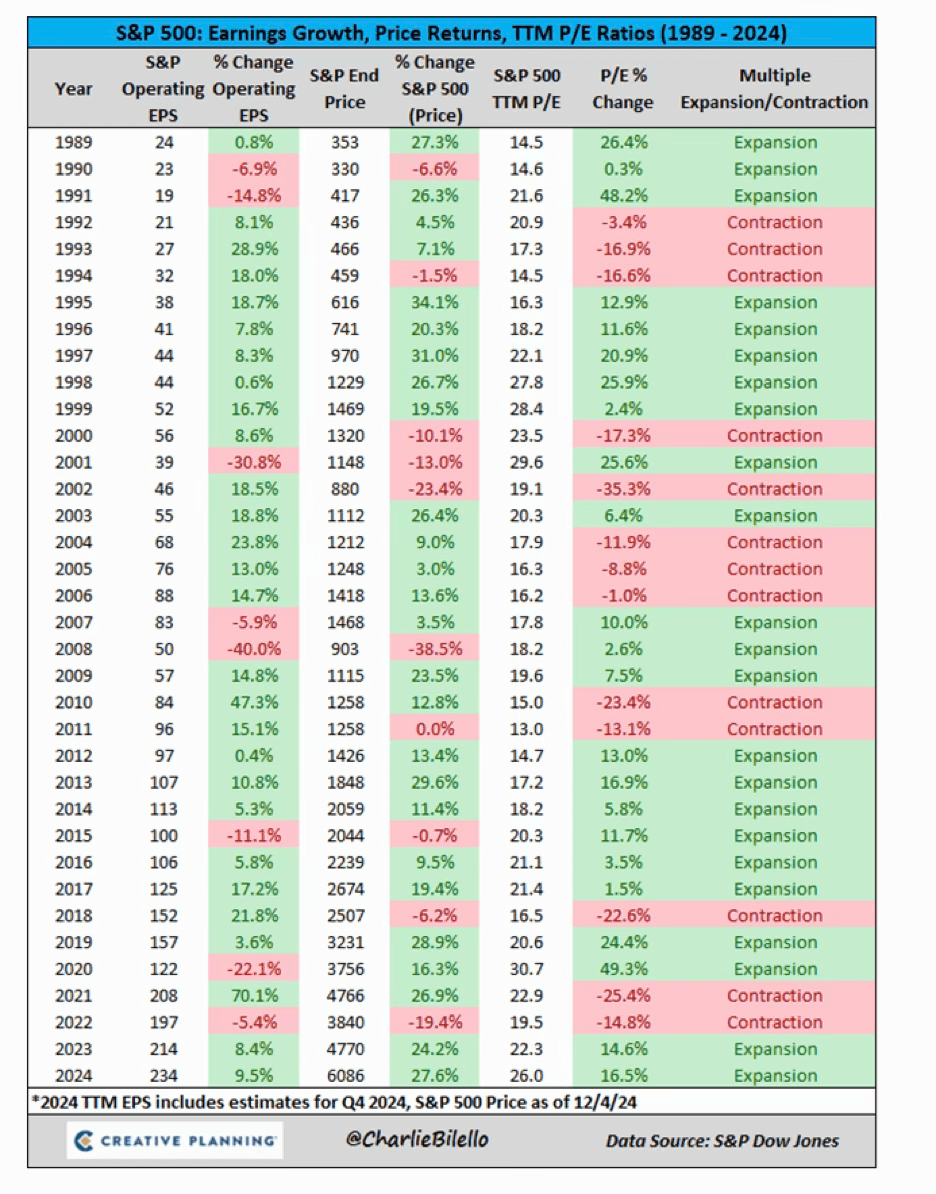

When looking at the direction of the stock market, you really want to focus on earnings. If earnings grow, then the stock market is likely to go up.

Here is a table from Charlie Bilello that demonstrates this point.

On the chart, you can see that there’s a high correlation between growth in earnings at the S&P 500 and price performance. Valuation didn’t really matter.

Next year could get pretty scary, but with continued growth and materially lower interest rates, stocks go higher.

Unfortunately, so will volatility.

Bitcoin Hits $250k

As you may recall, I made this same prediction last year. It was the only 2025 stock market prediction that I got wrong.

Although it feels further away than ever, I think 2026 is the year it will finally happen.

Lower interest rates, economic and earnings growth, and risk assets driven higher by increased liquidity can lead to explosive growth in cryptocurrency prices.

A move to $250k seems like a lot. But I think Bitcoin is headed to $1 million in the next few years, so this is just a step on the journey.

I may be right, or I may be proven wrong. But never let it be said that I’m afraid to take a stance on the market!

Hopefully, this will make you think about what’s possible out there.

Now let’s go out and make some money!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Forget the Noise, You're Not Bullish Enough

Posted January 29, 2026

By Enrique Abeyta

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner

Greenland, Carry Trades, and Lazy CNBC Takes

Posted January 22, 2026

By Enrique Abeyta

“TACO” Out… “Big MAC” In

Posted January 19, 2026

By Enrique Abeyta

What to Do While Silver Goes Vertical

Posted January 16, 2026

By Greg Guenthner